Thank you to our sponsor for this episode, Mortgage Automator.

Mortgage Automator

Private lenders, this one’s for you. If you’re not currently automating your internal operations, you’re likely spending a lot of time on tedious manual processes. If increasing efficiency and generating more business is your company’s goal, automation is the answer. Recently featured in Forbes and Entrepreneur Magazine, Mortgage Automator is a complete loan origination and servicing platform designed specifically to optimize your processes and automate your tasks, including all of your communication with the various parties involved in your transactions. It can help you generate and send out documents to the term sheets in seconds for digital signing. It’s also able to handle your payments, collections, accounting, and so much more. Focus your team on growth and let Mortgage Automator handle the rest. Go to mortgageautomator.com to book your personal demo and find out how Mortgage Automator can help your business grow.

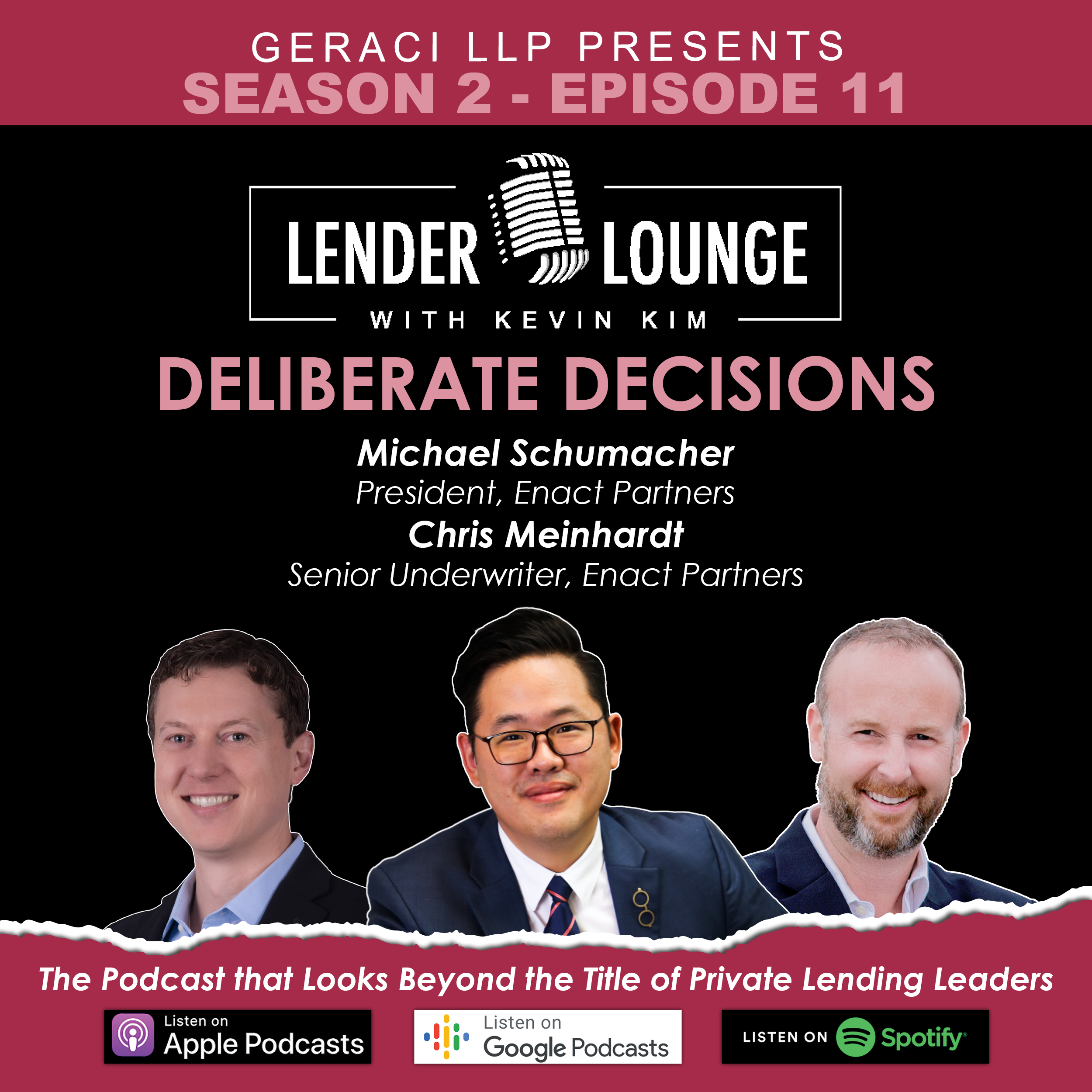

You’re listening to Lender Lounge with Kevin Kim, a podcast dedicated to the private lending industry. I’m Kevin Kim. And my goal is sit down with key figures in the private lending industry to talk about their business and their personal lives. We’ll get their takes on market conditions, the industry at large, and their personal stories. Overall, I really want to learn more about how they started and grew their businesses. So whether you’re a lender, a borrower, be a vendor, an investor, or anyone just interested in learning more about private lending, this podcast is definitely for you. Thanks for tuning in and enjoy this week’s episode of Lender Lounge with Kevin Kim.

Kevin Kim:

Hey, guys, Kevin Kim here for a new episode of Lender Lounge with yours truly, Kevin Kim. Today I have my friends and longtime clients, Enact Partners, welcome. Chris, welcome. You guys drove all the way up from Carlsbad?

Michael Schumacher:

Carlsbad, yeah. Thanks for having us.

Kevin Kim:

So we’re in Geraci headquarters today. We never get to do this, so I’m really happy that we’re able to do it in the office. So thank you for coming up, about an hour, two hour drive so-

Michael Schumacher:

Thanks for having us.

Kevin Kim:

… it’s not an easy one. Thank you for coming.

Michael Schumacher:

Yeah.

Kevin Kim:

So let us know, let our audience know a thing about, tell us who you guys are and tell us about the company first and then we’ll get into it.

Michael Schumacher:

Okay. So why don’t you start, Chris? Tell them who you are and then I’ll…

Chris Meinhardt:

Okay, so my name is Chris. I’m the new guy at Enact Partners, came over in March. I have kind of a varied background. I started as an engineer, doing construction engineering. Then I started my own contracting company in 2007, which didn’t work out so well. And kind of could do anything I wanted at that point. So I decided to join the Marine Corps, where I was a communications officer for four years. Did a stint in Afghanistan, which is kind of frustrating to see what’s going on right now.

Kevin Kim:

Yeah, it’s fresh in your mind right now, I’m sure.

Chris Meinhardt:

Yeah, exactly. So from there, I worked on a evening MBA program while I was still in the Marines. And through that, I got a job at Torrey Pines Bank, which is part of Western Alliance.

Kevin Kim:

Very cool.

Chris Meinhardt:

I wanted to get into real estate and I got a job doing underwriting in their CRE group. And after nine years I was introduced to Michael and he had an opportunity to come over to this smaller group, smaller team, which is what I really wanted to do. And came over in March and it’s been going really, really well. Excited about it.

Michael Schumacher:

Yeah.

Kevin Kim:

All right, Mike, we got to hear the story. I mean…

Michael Schumacher:

Yeah. No, we’re excited to have Chris on board. He’s been a great addition to our team. My name is Michael Schumacher. I’m the president and founder of Enact Partners. You and I have known each other a long time, [crosstalk 00:03:36], he’s been instrumental in getting our fund going for us in 2000-

Kevin Kim:

We’ve been working together since I think ’16 now?

Michael Schumacher:

’16 or ’17. Yeah, yeah. So the fund, you guys put our fund together. Obviously you guys help us out with loan documents, website, media, all kinds of things and we’re really grateful about that-

Kevin Kim:

Tell me, because you guys have a very unique focus as a private lender, right? Enact, you guys do a lot of construction.

Michael Schumacher:

We do, mm-hmm (affirmative).

Kevin Kim:

And you guys both have, because you’re dealing with construction background, but you also have a construction background, right? Or more of a builder background, commercial real estate background.

Michael Schumacher:

Yeah. My background has really been, the first 15 years of my career was in commercial real estate development. So building office buildings, industrial, retail, environmental mitigation banks, if you know what those are, historic rehab. So that’s where really where I started. My career was on the private side, going to public agencies and getting the approvals and the entitlements and things like that. And then building the office buildings.

Kevin Kim:

And then so Enact was founded in…

Michael Schumacher:

Well, we really started doing loans in 2013. Enact was founded in 2009. But we started doing loans almost by accident in 2013 and then just loved it, fell in love with it. And did it really more, started doing loans really personally. And did one and then did two and then did three and investors-

Kevin Kim:

[crosstalk 00:04:52].

Michael Schumacher:

Right, exactly. Yeah and investors, they liked it as well. And it just kind of grew organically from there.

Kevin Kim:

So today, it’s 2021 Enact Partners, what’s the credit box and product offering to the industry look like?

Michael Schumacher:

Yeah. So we do, as you said, we do a lot of construction. We do do land, depending on where they are in their entitlements.

Kevin Kim:

No raw land though, right?

Michael Schumacher:

No, generally not. It depends on what it is. Like we did a loan on an apple orchard, right? And it’s a business.

Kevin Kim:

Ag loans too.

Michael Schumacher:

Yeah. So we’ll do an ag loan. I mean, it’s got to make sense. It’s got to be a really low loan to value. It’s got to be a really good sponsor. Last week we closed an eight and a half million dollar loan on a Napa wine production facility. So they’re not a winery per se. They have grapes and they grow them, but they’re really producing. They’re doing the fulfillment for crushing and storage-

Kevin Kim:

You’re underwriting [inaudible 00:05:50] plant, more than anything else.

Michael Schumacher:

Well, we’re really using real estate as like, if we have to take this property back, what is the value? And can we sell it with the business or without the business? So-

Kevin Kim:

Pretty cool. And is it mostly commercial or are you guys also on the resi side?

Michael Schumacher:

No, we’re mostly commercial. We don’t do any owner OCC stuff. We do have some residential. We’re going to close this week, a couple condos downtown San Francisco. We’ve got a downtown San Diego condo-

Kevin Kim:

And that’s some properties.

Michael Schumacher:

… single family house, some small stuff like that. We like the residential side, but we don’t find ourselves really being competitive in that space. That’s a crowded field.

Kevin Kim:

It’s a very crowded field.

Michael Schumacher:

Right. And so with our background, Chris’s background in construction and development, my background and construction and development, that’s the space that we like. Obviously we’re not a high volume operation. We’re very-

Kevin Kim:

You guys are a boutique shop, definitely. But you guys have kind of built a reputation around being able to do a lot of the deals that our average private lender client, who’s doing your fix and flip deal, can’t touch. But then you’re also able to do the deals that, what I would consider your kind of like mid to small balance commercial bridge shops. They can’t do it, right? You’re kind of like, you’re able to be a little bit more nimble in that context, being a boutique shop. Now tell me about this. So when you guys started back in ’90, you said?

Michael Schumacher:

Mm-hmm (affirmative).

Kevin Kim:

Were you guys a developer back then? What’s the story of an Enact, when you were founded and when you transitioned to being a lender?

Michael Schumacher:

Yeah, so I started doing real estate development basically right out of college, went back and got my masters in finance, tax increment financing, the cruel irony is I live one of the only states that doesn’t allow it anymore, right, after 2009. And then during the great recession, during the downturn, I was hired on by a large private national retail developer, basically fixed their broken projects, in 2008, 2009. So I was the guy that was flying around and fixing their projects. I would do whatever I could.

Michael Schumacher:

I’d go to Fort Worth, Texas. I’d put in the wet and dry utilities. I built the roads, the retaining walls. And we would get rid of the properties anyway we could. We’d do a build a suit or a reverse build a suit, a ground lease. We’d sell it. We’d do whatever we could. And so I reported to that company and also their equity partner out of the East Coast. And so every week I was flying around and basically I was kind of the fixit guy, which has actually been really good for me because markets are very cyclical, right?

Kevin Kim:

Right.

Michael Schumacher:

And we are where we are, at a very high point in our market today, that’s not going to stay forever. And so having that workout experience-

Kevin Kim:

Not just workout experience, you’re actually resolving a lot of construction issues that most lenders don’t know what to do with. On paper, like, “Okay, well this needs to be fixed. Contractor, go fix it.” But what you’re telling me is that you guys are going to be able to… The way they’re doing it, you can evaluate whether that’s a sound method, right?

Michael Schumacher:

Yeah.

Kevin Kim:

Whatever they’re doing to continue the project or get it off its back essentially and fix the problems. You guys actually understand what those specific things are. Like if someone in my position, I would’ve no idea what retaining walls or engineering, what does that mean, right?

Michael Schumacher:

Right.

Kevin Kim:

But when you’re taking a trouble project and you’re trying to fix that as a lender, that’s a huge asset to have in your toolkit. I mean, a lot of us don’t really… I mean, some of us who came from the building world probably do. But a lot of our listeners are, they’ve been originators their whole life and this kind of stuff is foreign to them. So that’s very cool. So you were working for a national retail developer and then when did you break off on your own?

Michael Schumacher:

So in 2013, a friend of mine told me about these first trust deeds. And said, just for our personal investments. And so I did one. I called up a buddy of mine and said, “Hey, I’m going to do one of these deals. And I’m going to go into a little money. You want to go into a little money. By the way, I’ve never done this before in my life.” And he said, “Sure.”

Kevin Kim:

What kind of deal was it? What kind of deal?

Michael Schumacher:

It was 100,000 dollar loan on a property in Temecula, California. And it was on 18 acres of land and it had a really nice manufactured home on it. And lenders just weren’t lending on manufactured homes or they didn’t give any credit for land.

Kevin Kim:

Didn’t exist, yeah.

Michael Schumacher:

It was a father-son business that they needed to raise 100,000 dollars for. They owned it. Yeah, it was cash-out refi. It appraised for, I don’t know, 280,000 dollars or something like that. So it was a low loan to value. It worked great, it was perfect. So I did one loan, went in 50,000 with my buddy. And we each went in. I said, “Look, I’ve never done this before, so I have no idea how it was going to go.” But I was in the real estate space, so-

Kevin Kim:

Yeah. You understand how to read an appraisal.

Michael Schumacher:

Yeah, right. So we did it and that went well. And then I moved on to do another one. He said, “Hey, I’ve got a buddy that would like to do the same thing. Do you mind if we…” And I said, “Well, I got one too. So we got to make room for more people.” And then we did a third one and then a fourth one. And it’s just sort of,-

Kevin Kim:

So you really started as a trust deed investor.

Michael Schumacher:

Yeah.

Kevin Kim:

That’s interesting. So you were a real estate developer, construction specialist, having that background, and doing this as an investment while you’re working still, as Mr. Fix-It for these retail projects. So when did you like, “Oh, wow. There’s a business here. Let’s jump all in and convert the model,”?

Michael Schumacher:

It was probably like the fourth or fifth deal. I was still thinking about it as something that I was just doing on the side.

Kevin Kim:

And this is like ’13, ’14?

Michael Schumacher:

Yeah. ’13, ’14.

Kevin Kim:

Oh, the industry was so different, ’13 to ’14.

Michael Schumacher:

Yeah. I mean, institutional money really wasn’t there.

Kevin Kim:

Right and rates were still 12%, 10, 12%, right?

Michael Schumacher:

Yeah.

Kevin Kim:

I miss those days.

Michael Schumacher:

Yeah. Those were good days. I do too. I do too.

Kevin Kim:

Yeah. So were you working just in California the time, still doing deals here in California?

Michael Schumacher:

For the loans you’re talking about?

Kevin Kim:

Yeah, yeah. Yeah, yeah. Yeah, yeah.

Michael Schumacher:

Mostly California, mm-hmm (affirmative). We’ve done stuff in Washington-

Kevin Kim:

Right now you guys are in multiple states.

Michael Schumacher:

Yeah.

Kevin Kim:

But back then, when you jumped in, in ’14, it’s kind of interesting because we meet people today who are just learning about this stuff. And they’re starting to make their first trust deed investment as a lender or they’ve been lending on friends and family deals now they’re doing kind of like their first loan as a professional lender. And when we find people who enter the space like you did, which is very, very rare, my opinion. We see a lot of folks come in, either from Wall Street these days or coming in from like, “I’ve been a mortgage originator my entire life, setting up shop somewhere else, doing my own thing.” So you come in as an investor and a builder essentially. And for the folks that are just jumping in now, when the market is so different, take us back. What was the average LTV back then for deals? Like what, 50s, 40s, right? I mean-

Michael Schumacher:

Yeah, yeah.

Kevin Kim:

You were doing 10 and two, 12 and two, right?

Michael Schumacher:

Mm-hmm (affirmative), yeah.

Kevin Kim:

Was it construction back then too?

Michael Schumacher:

We didn’t start construction for a little while. I mean, we did more mainstream stuff in the beginning.

Kevin Kim:

Right, fix and flip.

Michael Schumacher:

Yeah, because I didn’t want to take it on as a project if there was going to be problem. So we did pretty basic stuff in the beginning. But as our deals got bigger, you can’t do multi benny anymore, now we started creating LLCs. And so one time we had like 15 different LLCs that we were managing, that’s a lot. And it’s almost impossible to scale a business if you’re creating new LLC for a four million, five million dollar loan. So that’s when it came to you guys and you guys helped us out with the fund-

Kevin Kim:

But what’s interesting is you’re saying a four million dollar loan, but this is like you’re progressing. But most people don’t transition from onboarding cash-out refis on resi deals that banks won’t touch to four or five million dollar commercial deals. It’s a big transition. Does that have to do with your background? Is that why, your career before this?

Michael Schumacher:

Yeah, I think-

Kevin Kim:

I understand this better?

Michael Schumacher:

I think so. And I would say this is still true for us today. For whatever reason, the smaller loans, the smaller deals, seem to be so much more work than the bigger deals. Because typically, when you have a large project, you’ve got the A team. You’ve got a sophisticated general contractor, sophisticated developer, they’ve got financial resources. They know what they’re doing. When you have these smaller-

Kevin Kim:

They’re well insured.

Michael Schumacher:

They’re well insured, exactly. And when you have these smaller loans, where it’s kind of mom and pop a little bit, it takes a lot of handholding. So you spend a lot of time-

Kevin Kim:

That’s a different perspective because I see this same perspective, but given to me in the context of the lenders business. Then the lenders are more sophisticated and their staff more sophisticated. But you’re looking at it from the borrower’s built team. Well, that’s a very good place to look is a lot of… That’s never really discussed. We never really talk about the quality of the contractor, the quality of the developer, quality of the architect, quality of the engineers. We don’t talk about that much on this show because while everyone is doing construction, I think it’s overlooked because we’re looking at, we’re always obsessed with values on this show for some reason, we’re talking about valuation a lot. I want to ask you now. Okay, so first of all, thank you for your service. Thank you very much for your service.

Chris Meinhardt:

Thank you, appreciate that.

Kevin Kim:

But okay. So you’re in construction, Marine, banker, and we had the same job. So you were underwriter on the commercial real estate team, right?

Chris Meinhardt:

Right. Nine years, yeah.

Kevin Kim:

So I did that. Bankers hours must have been good. And now you’re transitioning into private lending. I mean you go from, I mean fast-paced, fast-paced, bank hours, and back to fast-paced. You like the fast paced side a little better the bank hours? What do you think?

Chris Meinhardt:

I do, I do. I told Michael when we were talking about me coming over, when I was Marine Corps, I didn’t have to have an alarm. I woke up every day, just jumped out of bed, ready to go to work, excited about it. And no offense to banking or Torrey Pines, but it just wasn’t the same thing. And by the way, I really had a great time at Torrey Pines. It’s a great bank.

Kevin Kim:

That kind of banks is very entrepreneurial, so it’s a little different. But at most banks, it is boring as hell. You wake up at 9:00 or you get to work the 9:00 and you do the same file over and over and over again. Because most banks do the same loan over and over and over again.

Chris Meinhardt:

Right. Well, and that was a great advantage that I had at Torrey Pines because we do so much different stuff. I mean, I was doing term loans on medical office all the way to A and D, acquisition, development, land loans, doing big single family spec projects and everything in between. So it was a great learning experience for me to come over to Enact Partners where we’ll basically do anything under the sun, as long as it’s business purpose. I have experience in all that, so it really was great for me.

Kevin Kim:

And you have the construction background, which is huge for you and necessity for your team. And this raises an interesting question, is how shocked were you… I always ask recovering bankers this, when you transitioned to private lending, had you had any experience with how we underwrite, evaluate, and move? Because it’s a totally different way of doing things.

Chris Meinhardt:

It is, it’s totally different.

Kevin Kim:

Right, the idea of a credit committee is lost on us, except for us you’re big and fancy from Wall Street. But the idea of a credit committee, you are a credit committee-

Chris Meinhardt:

Right, we’re the credit committee right here.

Kevin Kim:

Yeah, and there’s some beauty in that efficiency, and that speed. But how much of a change was that for you? Give us a, I guess you on when you saw this, your first file, right?

Chris Meinhardt:

Right. Well, yeah. It’s been huge. I mean, like you said, Michael and I are the credit committee. We get to make decisions. We can make decisions in a day, whereas in banking, that’s not the case. You might have to go through four or five levels of approval. I mean, it could take two to three weeks just to get a term sheet out and by then you’ve lost the customer. So I really do like that about this space, is you can make decisions and just act on it and move.

Kevin Kim:

Mm-hmm (affirmative), mm-hmm (affirmative), and let me ask you this, when it comes to the borrowers though, because we’re talking about the quality of the borrow, because you guys are known for doing larger loans. You guys don’t do the 100,000, 200,000 dollar loans. You’re typically doing anything between one and 10, right?

Chris Meinhardt:

Yeah. I mean, we’ll do half a million dollar loans. We don’t do a lot under a half million. We would, if it’s the right deal, but that’s not really our market.

Kevin Kim:

Right, you’re supposed to be either one, one to 10 mark.

Chris Meinhardt:

Yeah.

Kevin Kim:

Yeah. And so when you’re dealing with a higher quality borrow, but still having to make sure because I feel like even in commercial, the borrowers are now used to private lending. They understand and have a certain expectation. And being a boutique shop, tell me about your borrower process, when you guys are working with a borrower, how does that look like? Because you say you guys make a decision in a day and then that leads to probably what? Funding within a week or two. And then what does that look like for you guys?

Chris Meinhardt:

Well, that depends on the situation.

Kevin Kim:

Sure. Average deal, nothing too crazy, yeah.

Chris Meinhardt:

Yeah. I mean, typically we would need to get an appraisal, especially if we’re talking about a construction project. So really, our closing depends on the appraisal. We do have some instances where we didn’t require an appraisal for various reasons. It was a very simple property. And in that case we can close in, yeah, two weeks, let’s say. But like you said earlier, I mean, it’s a lot about looking at the developer and developing a trust. Zoom has helped a lot with that because we can quickly just have a meeting ‘face-to-face’ with the developer-

Kevin Kim:

Better than a phone call.

Chris Meinhardt:

It is. It really makes a big difference. And you just get a good feel for their experience and how much they have thought through the project. Like you said earlier, we look at the contractor, architect, make sure they have a good team. And if we get a good feel for the team, then we can move forward.

Kevin Kim:

Let me ask you this, how do you guys evaluate those team members? I’ve actually always wondered this. How do you really evaluate the quality of a contractor and this team, and a developer, or an engineer? What are you guys looking for? Because in our space, we’re having to move quick. A lot of it comes through reputation, I’m sure. But what other things are you guys looking for when you evaluate that team?

Chris Meinhardt:

Usually what I look at is the website, to be honest. And look at their former projects and if their former projects are similar to what we’re doing now and they look good and-

Kevin Kim:

So track record.

Chris Meinhardt:

Exactly.

Kevin Kim:

Same thing with lenders too, right?

Chris Meinhardt:

Mm-hmm (affirmative), and we’ll go on site and meet with the contractor. We’ll go into the construction trailer, look at the Gantt charts, schedules on the wall, go through the whole thing. And you can tell. I mean, if they don’t have a construction trailer, that’s-

Kevin Kim:

You go on site and they’re set up like a legitimate shop. Yeah, yeah. Yeah, yeah. Okay. And on the insurance side, is there anything specific that you guys require? Because this is a different thing, it’s a whole different world to me. I don’t understand this world and this makes me curious. When it comes to these types of projects, how does the insurance and the bond process look like, and requirements look like for you guys?

Michael Schumacher:

Mm-hmm (affirmative), well, there’s a couple levels. There’s the sort of hazard insurance. We make sure that they have Course of Construction, Builder’s Risk. We want to make sure that if a supplier delivers a bunch of two by fours to the site and those things are stolen, that we’re held a beneficiary for those-

Kevin Kim:

Which happens, right?

Michael Schumacher:

Yeah. It absolutely happens, for sure. And we’re looking at the security, where they’re storing their materials and kind of stuff. So of Course of Construction, Builder’s Risk, that kind of thing. As far as title insurance is concerned, we’re doing period kind of date downs to make sure there’s no liens that are… Getting all lien releases, going through that normal draw process.

Kevin Kim:

Are you requiring any specific insurance from the developer or the contractors, besides the usual?

Michael Schumacher:

Yeah, there’s several different endorsements that we require the borrower to provide. But we have a much more hands on relationship with our title insurance companies along the way versus a regular non-construction project. You don’t really see them ever, after the closing unless there’s an issue, yeah.

Kevin Kim:

And what are your guys’ thoughts on how much the market has now adopted construction? It’s more on the resilient side than on the commercial real estate side. But even three years ago, I mean, finding a lender that would do a construction loan, it was pretty kind of rare. Today, everyone and their mom does it. And primarily because Wall Street started buying this stuff, on the resilient side primarily. But what are your thoughts on that kind of stuff? It creates a lot more competitive nature in the market, but I venture a guess at the quality and the evaluation of the team, builder team, that kind of stuff’s not happening. What are your guys’ thoughts on that?

Michael Schumacher:

Well, the market has definitely shifted. That old adage of you get what you pay for is a little different today. It’s you get what you get and you pay what you pay. So the yields used to be much higher and the risks appeared to be lower. You had lower loan to values, like you said earlier. Today, we’re seeing lenders that are lending at 100% purchase and 85%, or 85% purchase at 100% of the construction. That’s just, we lose out on those deals and that’s okay. That’s just not our space. So there are a lot of people doing construction. And as long as we’ve got the wind at our backs, everything’s going to be fine. But our focus is to be here throughout the next downturn, whenever that comes and we want to survive it. And I think there’s going to be some people that are going to find themselves in a little bit of trouble, especially on construction projects.

Kevin Kim:

Let’s talk about that, because both of the commercial and on the resi side, COVID was a good indicator of where the weaknesses are. And we’re starting to see the same. It is funny because we’re barely out of it. Today, it’s September in 2021, by the time this episode airs, we’ll probably be in October. But the thing is, we’re at the tail end of 2021, we’re still in the pandemic. But 2020 taught us an issue of liquidity, of capital partners, taught us an issue, a challenge of what do you call it? Raw materials and these things, but we’re starting to see the same risk being taken, I think, from a construction standpoint especially, construction lenders at least. Where do you see the gaps in the market and opportunities for an act in the next few years as things taper off or correct if you will, for you guys to kind of capitalize?

Michael Schumacher:

Mm-hmm (affirmative), so for us, we’re focused on the western third of the United States. But candidly, every loan in our fund, we have some loans outside of our fund still. But every loan in our fund is in California and it’s because we’re here and it’s California. But it’s hypercompetitive. But there’s a lot of underserved markets out there. There’s parts of Idaho, Wyoming, the Midwest that I think there’s opportunity and they just simply don’t… There’s not a market. There’s a market, but there’s really nobody there. So that’s what we’re going to-

Kevin Kim:

We’re starting to see some attention to Ohio and some of the Midwestern states, it’s kind interesting actually. We’re trying to see some companies push out there.

Michael Schumacher:

Yeah, yeah. And so that’s where I see the opportunity. I think that we’re going to start to push out a little bit more and be more active about getting loans in other states. Recently it’s been more of just, “Hey, there’s a deal, a nice deal on Montana.” And we look at it and we like it and we like the borrower and we want to do it. But not really being deliberate about it. And that’s something that we’re actually starting to push out a little bit more.

Kevin Kim:

So you’re expanding into other markets, but let me ask you this. So until now, have you guys relied on whether I consider like the institutional capital providers or Wall Street aggregators to aid in the business? Do you guys sell loans? Or you guys working on… I think you have a credit line with a bank. But besides that, like in the fund, but have you been that reliant on Wall Street at all?

Michael Schumacher:

Not at all.

Kevin Kim:

Not at all?

Michael Schumacher:

No.

Kevin Kim:

Not a one.

Michael Schumacher:

No.

Kevin Kim:

Oh, wow. Yeah.

Michael Schumacher:

Yeah.

Kevin Kim:

That must temptation to say, it’s hard, it’s hard to say no to that temptation. I mean, it’s pretty easy to get board with those guys these days.

Michael Schumacher:

Well, the temptation is there for sure. I mean, we’re definitely a Main Street lender, not a Wall Street lender. And what we saw during the downturn, our phone was ringing off the hook… Not the downturn actually. But after March 2020, COVID-

Kevin Kim:

Yeah. Let’s call it the-

Michael Schumacher:

Where things got a little scary.

Kevin Kim:

What were things like? March hits, those two days in March where everyone was just kind of like, “Oh crap.”

Michael Schumacher:

Right.

Kevin Kim:

I remember calling you, I remember calling a few other clients. And it was funny because I represent mostly balance sheet lenders. So I was like, I was confident. And then my partner was like, “They’re freaking out.” I’m like, “Not my guys.” But anyway, anyway. But tell me about how it was working you guys and how things evolved during that six month process for you guys. We popped back up in September, I think. Everyone kind of like stabilized a little bit. Tell me about that period.

Michael Schumacher:

Yeah. I mean, initially in March it was concerning for everybody because nobody knew where it was going to go.

Kevin Kim:

Right, can we even build anymore?

Michael Schumacher:

Exactly. Is everything going to stop? But the six months after March 2020, we were really busy. I mean, our phone was ringing off the hook with people saying, “Hey, my…” It was all Wall Street money, institutional money, just kind of gone away-

Kevin Kim:

Originally those were calling you get help.

Michael Schumacher:

Yeah. And our investment group, they were fine. They were like, “Okay, well let’s just continue to do deal by deal. And cherry pick the ones that we like and just continue on.” So it was actually really good for us. I mean, we-

Kevin Kim:

Did you raise [crosstalk 00:26:38]a little bit?

Michael Schumacher:

Not really.

Kevin Kim:

No?

Michael Schumacher:

Not really.

Kevin Kim:

That’s good.

Michael Schumacher:

I mean, maybe a little bit, but not much.

Kevin Kim:

We saw some folks charge a little more because I mean, the market can bear it now.

Michael Schumacher:

Yeah, yeah. Right, absolutely. But that rebounded pretty quickly. I mean, like you said, it was probably six months and then institutional was kind of back into the space. But what it did was it revealed what happens when things get a little scary. Then who’s going to be around and who isn’t? And when you look at what happened in 2008, the great recession and traditional lending and things got really, frothy. Obviously traditional lenders were lending to high loan to value properties, 100% financing sometimes to borrowers that-

Kevin Kim:

Like we’re seeing today.

Michael Schumacher:

… kind like we’re seeing today. And the end result really was a lot of regulation that happened after 2008, 2009 in the traditional space. And so-

Kevin Kim:

Oh, Dodd-Frank, 2012.

Michael Schumacher:

Right, exactly. Right.

Kevin Kim:

I remember when the law came out, where all of us here were just like, “What is this? How? What?” It was this giant set of rules that impacted everybody. If you touched the mortgage, you were now having to go walk through a mountain of tape. It was nuts.

Michael Schumacher:

Right, and is the consumer any safer because of it?

Kevin Kim:

I would argue if you are on the conventional, true conventional and 10, 20% down, I think so. But if you’re dealing with some of this non QM stuff or some of the DSCR, that’s getting a little frothy, I think we’re starting to see hints of subprime again, a lot of risk being taken, unnecessary risk being taken. And the borrower is glad to get the deal. But I think they’re going to… Well, they’re going to be able to get themselves out of it while things are hot. If they don’t get themselves out of it while things are hot, they’re going to be stuck.

Kevin Kim:

And that’s going to be that bad. That’s going to be a bad time. Yeah. So I mean, agree with you being the big picture. I mean, but let me ask you this though, because we’ve had this discussion with other lenders, the idea of avoiding regulation. And we should make sure that we’re staying conservative to avoid regulation. Other folks have argued that because this industry is so fractured and because this industry, we have guys who, on the same balance sheet, we’ll do 100 or multifamily fix and flip, rent alone construction deal on a mixed use. They’ll mix it all together. So from a regulator standpoint, they don’t know what to do with us.

Kevin Kim:

We’re so fractured. We do a little bit of everything. That’s changing, but still to this day. And from a regulatory standpoint, if I’m the banker’s regulator or I’m the mortgage regulator, we look like commercial operators. We don’t look like consumer lenders. And so that’s the argument like, “Hey, you guys aren’t touching the consumer.” And I think that’s allowed a lot of people to go kind of cowboy and really go hard. And what are your thoughts on the idea of staying commercial and that keeping us out of hot water, that kind of argument? Because people have made that. We don’t touch a homeowner, if you will.

Michael Schumacher:

Well, that’s true. But if the industry sustains a lot of losses and those losses are investor losses, then the regulators are going to come in. It may not be the homeowner that’s in the house because it’s a traditional type loan. But if you’ve got a lot of investors that have lost money-

Kevin Kim:

When you say investors, you’re talking about the people who are investing in the real estate and those investors.

Michael Schumacher:

Well, the ones that are also investing in the loans.

Kevin Kim:

That’s true, yeah.

Michael Schumacher:

And so if they sustain a loss, then the regulators are going to probably, at least there’s a chance they’re going to start to focus and say, “Hey, look, there’s not enough regulation here because there’s a lot of private money lenders that were lending 100% loan of value and got ahead of their skis,” even though it was commercial, there’s-

Kevin Kim:

So would you say then the biggest concern in your mind would be the types of frameworks that we see in conventional being imposed onto us, like the whole idea of 20% down, or PMI, or ATR, those kind of things you see in conventional being opposed on us?

Michael Schumacher:

That’s my concern. When there’s a shift, will the regulators come out and start to focus a little bit more on our space? I don’t know-

Kevin Kim:

Especially on the right side of the business. I mean, we’re starting to see that and we’re starting to see concerns of that in the DSCR sector. Do you guys do DSCR, the rental loans?

Michael Schumacher:

No, mm-mm (negative).

Kevin Kim:

Build the rent is now kind of a thing now, isn’t it?

Michael Schumacher:

Yeah.

Kevin Kim:

Yeah, okay. So let’s switch gears a little bit. I want to talk about, you guys are focused on the western states, and construction is one of your biggest kind of like strong suits, but construction is a hot topic right now. A lot of people are complaining about, there’s not enough construction. We need more construction lenders. What have you guys seen so far these days? I mean, is it picking up a little bit? Are we getting more units being built, both in apartments and in homes? Is it happening or is it not? Because I’ve been hearing a lot of speculation on this, both sides.

Michael Schumacher:

Yeah. I mean, I think we are. But if you look at the numbers over the next couple of years, there’s still a deficit of housing.

Kevin Kim:

It’s severe apparently.

Michael Schumacher:

Yeah. It’s pretty severe. And so two to three years out, I think we’re still catching up a little bit. I don’t know what happens after that. But yeah, we’re seeing a little bit of a slowdown in some markets in terms of just regulatory, like getting stuff, the permits through-

Kevin Kim:

It’s even slower, even slower, huh?

Michael Schumacher:

They’re on Zoom or they’re not working, it’s even slower. And it’s-

Kevin Kim:

Well, California is known to be terrible for getting permits and entitlements. I mean, it’s even slower, that’s nuts.

Michael Schumacher:

Yeah, and we’re seeing that. We’re seeing borrowers coming to us and they say, “Hey, this is our plan. We want the loan, we’re going to have a grading permit in the next 30 days.” And then all of a sudden, it’s six months later and they still don’t have a grading permit.

Kevin Kim:

Six months.

Michael Schumacher:

I mean, it can be pretty long, yeah.

Kevin Kim:

Unless You’re Toll Brothers, or Lennar, or something like that. Yeah, yeah.

Michael Schumacher:

Yeah, right. If you’re a midsize builder, building 50 homes that may not be the case.

Kevin Kim:

Are you guys still seeing the popularity of the master plan? I don’t see as many master plans being built anymore. It’s not as popular.

Michael Schumacher:

Yeah. I mean, I think that they’re out there, it’s just that in the populated areas we’re running out of space.

Kevin Kim:

Mm-hmm (affirmative), yeah.

Michael Schumacher:

And so a lot of the properties are being picked over. So in the populated areas, the projects are smaller or they’re going out into tertiary markets around Sacramento and that sort stuff, where there’s still a lot of land and they can do larger projects.

Kevin Kim:

Right. So what do you guys use to evaluate your markets when you guys are lending? Because it is interesting on construction, I’ve had this discussion with other lenders who do this, evaluating a market to lend in is to me, I was like, “I didn’t even think…” A lot of them look at like population demographics. Not just density, but demographics. They look at recent shift and school. I mean, what do you guys look at when you guys look at a new market?

Michael Schumacher:

Yeah, we look at the demographics. We look at what’s going on in the market. We’ll go talk to the city, we’ll find out what’s been happening in the different parts of the town, but-

Kevin Kim:

Oh wait, you’re talking to the city?

Michael Schumacher:

Mm-hmm (affirmative).

Kevin Kim:

Oh, so not the local guys who are operating the city.

Michael Schumacher:

Yeah, we’ll talk to the city as well, mm-hmm (affirmative), yeah.

Kevin Kim:

Oh, okay. [inaudible 00:33:59] to look at it.

Michael Schumacher:

Yeah. And you know that I used to be on the Planning Commission and the Carlsbad City Council, so I’ve got that on the other side. And that helps for us to understand both sides of the equation.

Kevin Kim:

Right. You understand the politics.

Michael Schumacher:

A little bit on the politics side. But one of the things that I think that we all benefit from in this space. If you were here in 2008, 2009 is for good or bad, we’ve all lived through the great recession of 2008. And so when we look at properties and we look at 2008 against, call that the low water mark. What was this property, what were these home selling for in 2008, 2009? And we use that as a metric now. I’m not saying that we’re going to go back to the prices of 2008, 2009. But if you use that as a low watermark and that’s at least some gauge-

Kevin Kim:

Your worst case scenario.

Michael Schumacher:

Kind of a worst case. And if we’re still okay, our average loan to value on our portfolio is about 50%. So we’re pretty low. We probably could go back to 2008, 2009 numbers and be okay.

Kevin Kim:

Right and your masters-

Michael Schumacher:

Not that we want to do that.

Kevin Kim:

But no. Well, that’s interesting. So we do have a handful of clients that are known for having their low LTVs. But the challenge with that is, is that they’re going into markets where they know they’re solid on valuation. Even they’re looking back at ’08 numbers and even in ’08, the numbers didn’t shift, maybe 5%, 10% shift. But it’s because of the values in the neighborhoods. But today, with the whole great migration, people are leaving what used to be a great place to live and now they’re leaving. So how has that impacted you guys from a value and going into new markets? Because let me ask you this. Are you now considering Tennessee? A lot of people in Southern California are moving to Tennessee. Same with Florida, Texas. Are these markets that you guys are considering now when you are mostly Western United States?

Michael Schumacher:

Yeah. We’re not really considering going out to the East Coast. I know the Carolinas are really hot as well. Yeah, Nashville is super hot. Obviously Austin, Texas as a whole is really hot-

Kevin Kim:

And they’re building.

Michael Schumacher:

Yeah, they’re building. But building, I’ve done building in Texas as well. Building in Texas is not the same as building in California. Supply and demand are generally in check. In California, if you need 100 homes, if you have a demand for 100 homes, it’s going to take five years to go through the planning process, and permits, and environmental challenges, and everything else for. I mean, maybe that’s an exaggeration, but it takes a long time and very expensive. If you’re in Texas and you need 100 homes. You go out and Billy Bob’s back 40 and you build 100 homes. And within six months or nine months supply and demand are in check. It’s just so much easier to market there. And it’s much more responsive. Where in California, the demand builds up.

Kevin Kim:

I mean hell, in Houston there’s no zoning law, so you can literally build a house next to a gas station.

Michael Schumacher:

Yeah, right.

Kevin Kim:

So you’re saying there’s a speed in which it’s harder for you to compete in these markets. Because they move real fast.

Michael Schumacher:

Yeah, absolutely fast. But we look at markets like Idaho and look at-

Kevin Kim:

Another popular area to move.

Michael Schumacher:

Yeah, even Wyoming. I mean like Jackson Hole and that area and even the surrounding towns around Jackson Hole.

Kevin Kim:

I was just flying out of Vegas and I’ve never heard so many flights going to Wyoming and Montana in my life. Just more flights going that part of the country. You never used to get a flight to that part of the country.

Michael Schumacher:

You’re talking about the great migration, there’s a lot of people out there that lived in California or have one foot in each, a lot of people. I mean, I’ve got friends, I’m sure you do too, that have just wholesale. I’m packing my bags and I’m moving out. Yeah.

Kevin Kim:

I mean, to this day, I’m still looking at houses in Plano. Plano seems to be the place. My wife’s like, “If we’re going anywhere, it’s going to be Plano.” Because they got a Korean market in Plano, so we’re going there if we’re going anywhere. But it’s crazy because the whole idea of moving to a… I’ve never lived out of the state, I grew up here. But people are just packing on their bags and moving. And it’s still happening, it wasn’t a COVID thing. They’re still doing it. And the Northwestern United States seems to be very popular, Southeastern United States, very popular. Now, in the Northwestern part of the United States, now you guys are looking at those areas to transact in, are they building? Are they building new homes? Are they building new, I guess, communities, includes retail, and office, and whatever you have up there, you need to build to actually have a community? What are they doing that’s attracting you guys?

Michael Schumacher:

Yeah. I mean, the Portland market is pretty hot and there’s a lot of multifamily going on out there. A lot of good size projects that are really above the size that we would do. Again, we’ve done deals in those markets, but not really deliberate. So we’re going to start to push out and be a little bit more deliberate in those spaces. But there’s definitely a lot of activity out there. The Boise market and-

Kevin Kim:

Coeur d’Alene.

Michael Schumacher:

Coeur d’Alene. I mean, there’s a lot of-

Kevin Kim:

What’s the typical kind of transaction you’re seeing in Coeur d’Alene? Is it residential home builders or is multifamily? What are you guys usually seeing?

Chris Meinhardt:

Just seeing both.

Michael Schumacher:

Both. Yeah, definitely.

Kevin Kim:

It’s all residential related though these days, right?

Michael Schumacher:

For the most part, for the most part, yeah. We’ve got, yeah. Yeah. We had a deal that we recently got paid back in Seattle. It was a piece of property right downtown Redmond across from the Microsoft campus. And we just did the land loan for it. But I don’t know how many hundred million dollar project they’re going to build multifamily up there. And so we’re seeing a lot in the urban areas, a lot more density, obviously, similar to what you’re seeing in California.

Kevin Kim:

But it’s also hard to build out here, isn’t it? I mean, I don’t know Seattle. I would imagine Seattle’s pretty hard to build as well. And the process is so different, state to state. How are you guys preparing for that? Because it’s one thing to do a flip, or a refi, or something like that. But when you’re dealing with construction loans, you have to, like you said, like the California build process is so thorough. And when you’re going into a different market, but that’s a blue state that predictably, will have those types of bureaucracies, but different. How do you guys plan for that kind of stuff in advance, as lenders try to expand into different markets? What are you guys doing to prepare for that?

Michael Schumacher:

Yeah. So we’ve got land use people on our team, locally, that will go out and actually, we’ll send them out to go look at the property and deal with the city and the county and make sure that we understand what’s going on.

Kevin Kim:

And they know what to do when they’re speaking with the actual, like the bureaucrats and the politicians as opposed to just the land itself, right?

Michael Schumacher:

Right, right, yeah. And there’s nuances obviously, from state to state and even city to city. I mean the city next to this one, it’s different, right?

Kevin Kim:

Right.

Michael Schumacher:

Every city handles things differently, every state handle things differently. But we’re not going to go to another state and give an entitlement loan. They already have to have that stuff. They basically are going to have to be shoveling. So at that point, we’re not going to take on a tremendous amount of risk.

Kevin Kim:

There’s a certain amount of risk you guys are willing to take, but that kind of risk is really meant for your backyard.

Michael Schumacher:

Right.

Kevin Kim:

Okay, that’s fair. I think that’s a good way to look at it. It’s nice and conservative, you know exactly how you’re going to approach it if you’re taking that kind of risk. Let me ask you this though, so whenever I talk about construction and commercial and one of the things that is a hot topic, it’s always been a hot topic in my mind, it’s cannabis. A lot of our clients do it. A lot of our clients are thinking about do it, not doing it. Now with this pilot program coming out on the title side, have you guys done any cannabis deals? Or your thoughts on cannabis.

Michael Schumacher:

We haven’t and we don’t. Not because we have some kind of judgment about it. It’s just that we’ve told our investors that we wouldn’t. For me, I hear a lot of people talk about, “Well, I don’t want to do it because the Feds, it’s still on schedule,” and that kind of stuff. I don’t really see that as being the case. I mean, it may be an issue, I don’t know. But what I have seen is, and we’ve actually had a borrower that we did not give a loan on a property in Palm Springs area. And the City Council said, “Hey, we’re going to allow cannabis in this area.” And he went and got a loan and bought the property and put cannabis in there. The neighbors came out with pitchforks. The community came out and said, “We don’t like it.” There was a lot of pressure. And really then, with the same pen that the City Council used to say, “You can do cannabis in this area.” They said, “No, we’re-”

Kevin Kim:

They removed the zoning.

Michael Schumacher:

They removed it. And they said, “No, it’s…” So soon as your tenant’s out, it’s out. And so that’s really more of a local regulation thing that really doesn’t show up in the headlines.

Kevin Kim:

I thought it was so popular in all of California. I mean, what are your thoughts on this?

Chris Meinhardt:

Well, that’s what I was going to say is it’s so popular that I look at that as a danger. There’s so many people getting into this space, it’s going to get overcrowded.

Kevin Kim:

It’s already overcrowded.

Chris Meinhardt:

Right, exactly.

Kevin Kim:

There are public companies landing on this stuff now.

Chris Meinhardt:

Right, yeah. So it’s hard to know who’s going to survive through this and who’s going to fall off. So it’s a tough market.

Kevin Kim:

Yeah. And it’s interesting to me because it’s a challenging issue. Because that means it’s also getting more legitimate to me. At least the real estate stuff, not the loans that touch the plant or the loans that are factoring these guys. Not that type of lending, but the real estate component of it is becoming so much more standardized. And yet, most commercial real estate lenders that I speak with take the same position. It’s oversaturated, it’s not a risk issue, it’s a comfort issue. We’re okay. We can underwrite the risk, but we’re just not comfortable with it. Not because of federal, because it’s just a matter of comfort.

Kevin Kim:

But yet, it is going mainstream and it is becoming wildly popular with a certain subset, especially folks who are doing construction loans. I mean, in the future, for Enact, would that be on the table? Let’s just say with the federal approval and the title covered it and everything else like that, it’s kind of a more traditional asset class, would it be okay with you then? Because industrial, on its face, is a very attractive asset class. And a majority of that’s being used either for e-commerce or cannabis, in California, at least. So I mean, what are your thoughts on that kind of stuff?

Chris Meinhardt:

Well, and that’s mostly what we see, it’s not the dispensary. We’re seeing the guys who are wanting to grow.

Kevin Kim:

Yeah, yeah. But also, you said you do ad loans. And it’s kind of an interesting challenge, we always have to follow the market. And if this stuff becomes fully legal and you start getting requests for the equivalent of the vineyard. But now it’s for a grow operation. I mean, we’re headed in that direction, I feel like.

Chris Meinhardt:

Mm-hmm (affirmative), yeah. I still would have concerns of the oversaturation. And you know that once it becomes federally legal, then the Philip Morrises of the world are going to get into it-

Kevin Kim:

That’s true, I agree with it.

Chris Meinhardt:

Heineken is looking, get into it over here at some point, out of the Netherlands. So there’s a lot of risk there from a business standpoint, even when the regulations allowed, I think-

Kevin Kim:

Put the operator out of business.

Chris Meinhardt:

Yeah, we’ve heard of that happening. A couple clients that led into a [inaudible 00:45:05] here and there. They couldn’t make rent. So it happens.

Michael Schumacher:

Valuations are tough as well. I mean, we’ve looked at several of the deals. We wouldn’t put in our fund for the reasons I mentioned, but some of these buildings that you wouldn’t let your dog sleep in and the valuations they get, you’d think it was a class A building. And it’s like, well, okay yeah, if it is that use, but-

Kevin Kim:

Green valuation, for sure.

Michael Schumacher:

Right, but if it has to be tomato storage, that’s not going to work, it’s not going to pay the rent.

Kevin Kim:

Right, right, the second you install lamps and an advanced HVAC system, the value is triple. I don’t think so.

Michael Schumacher:

Right, exactly.

Kevin Kim:

I don’t even do there. And there’s a lot of frothiness when it comes to those valuations. But I think that’s also added on, on the industrial side. The popularity of industrial is massive. I’ve never seen so much industrial globe, I mean, ever. I live close to an industrial area and it’s like, they’re just continuously building. They’re tearing down and building, and then repurposing, and building more, and building more. It’s almost as if we’re going into a world of apartments and warehouses, it’s crazy. And I mean, talk about that real quick. How does underwriting industrial change for you guys? Because it’s becoming the mainstream asset class in commercial and everyone wants to do it.

Michael Schumacher:

But I don’t think that’s new. Historically, if you look at commercial, like at the basket of commercial, office, industrial, retail, things like that, the performance of industrial has always been the outperformer compared the other ones.

Kevin Kim:

But with added things to date, with cold storage and e-commerce. And I mean, it just seems to be just increasing it even further, right?

Michael Schumacher:

Right, oh yeah. I mean, there’s such a huge need for the distribution. It’s not only distribution, but it’s like when you return an Amazon package or something like that-

Kevin Kim:

Where does it go?

Michael Schumacher:

… you need a place to go take it back in. So yeah-

Kevin Kim:

I know, even these guys who are doing these small eBay businesses and Amazon businesses, they run out of a small light industrial warehouse and they operate their business out of that. So it’s like, to me, I’m just like, “Well, this is where we’re headed, apparently.” It’s a sign of retail dying, I guess my point is. And how are you guys dealing with that shift in the market? It’s mass popularity.

Michael Schumacher:

Mm-hmm (affirmative), yeah. Well, I mean, every deal stands on its own. And the loan to value, the sponsor, the strength of the sponsor. I mean, we see great industrial projects and we see not so great ones, same with commercial, same with residential, so-

Kevin Kim:

I feel that today, any industrial deal is like, it’s almost bulletproof it feels like, everyone wants it.

Michael Schumacher:

But it’s expensive. People are paying a premium, for sure.

Chris Meinhardt:

And it depends on the tenant situation too. I mean, I don’t know that we would do a spec industrial build. But if there’s a solid tenant that they have lined up with a lease or at least an LOI and it feels pretty good, then we would consider that.

Kevin Kim:

Okay, that’s good to hear. You’re sticking to your guns and being conservative about it because it’s challenging. And I view the industrial as very much along the lines of kind of on the resi side for our private lending industry, because both are immensely frothy right now. And people are paying a premium and they’re going after it as hard as they can. I want to switch gears to resi real quick. And then we have to shift toward some market condition topics. But on the resi side, how much are you guys involved in resi? Are you guys doing a lot of construction loans right now on the residential side or not really that much?

Michael Schumacher:

Small, small. We’ll do-

Kevin Kim:

Small percentage?

Michael Schumacher:

Yeah. But we’ll also do horizontal construction-

Kevin Kim:

On resi?

Michael Schumacher:

On resi. Which is a little bit, somewhat unique we find. There’s a lot of lenders that will do-

Kevin Kim:

For our listeners, they should listen in, Enact Partner says horizontal on residential.

Chris Meinhardt:

Yes. But we don’t only do horizontal-

Kevin Kim:

But they’ll do it. No, the interesting part is, there’s not many folks who can do that. They don’t have an underwriter. So they’re usually going to have to come out of pocket for that kind of stuff. At least how I see.

Michael Schumacher:

Right, yeah. Yeah.

Chris Meinhardt:

Yeah. And I only mentioned that because I’ve seen so many land requests coming in because obviously when we say we do land, everybody’s ears perk up, but-

Michael Schumacher:

And then you get all the garbage.

Chris Meinhardt:

And then I just get all land deals. But we do everything.

Kevin Kim:

Yeah. I mean, you guys are flexible and you guys can do the construction, but you have the skillset to handle the right land deal on residential as well. And so talking about how popular construction on resi is right now. And I mean, how challenging is it for you guys to say, because resi is on fire. Resi is just bonkers and CRE has had its challenges over the past, I would say eight months, especially retail. And it’s been a very challenging place, especially for the bigger ticket projects. Talk about, have you guys ever had to had that discussion internally, like, “We’re sticking to our guns, we’re not jumping into resi? Because a lot of folks have. And talk about that real quick. I mean, the issue of I guess for me, looking at the market from where I am, I see a lot of folks transitioned away from commercial and doubled down on residential. What are your thoughts on that?

Chris Meinhardt:

Well, we don’t really operate that way. As Michael said, we look at it on a deal by deal basis. So we’re not the type to say, “We’re not going to do retail, we’re only going to do residential,” or anything like that, so-

Kevin Kim:

It’s [crosstalk 00:50:26] deal you’re saying.

Chris Meinhardt:

Exactly, a deal stands on its own. And if it makes sense and if we feel good about the developer, then we’ll do it.

Kevin Kim:

Excuse me. Let me ask you this then and this is an interesting way to look at this is how often do you guys saying no? Because there’s all kinds of deals that are coming out right now. It’s a lot of, I’m going to call it speculative deals, especially on the build side. And so how often are you guys saying no to these applicants and these originators out there?

Chris Meinhardt:

That’s tough to say. It’s probably-

Michael Schumacher:

Half and half.

Chris Meinhardt:

That’s still good. I mean, I always tell people on the show, saying no is probably one of the best things you could do in this space.

Michael Schumacher:

Mm-hmm (affirmative), yeah. You got to kiss a lot of frogs in this industry. You really do. You got to look at a lot of deals because they’re not going to work out, it’s sponsorship-

Kevin Kim:

Being comfortable saying no is important.

Michael Schumacher:

Yeah. We say no a lot.

Kevin Kim:

It’s not a bad thing to say that-

Michael Schumacher:

But we try to do it quickly, right?

Kevin Kim:

Right, pull off that bandaid.

Michael Schumacher:

Right. And when provide a loan, maybe a construction loan to a borrower, that’s doing a land development project, generally, they’re going to be pretty sophisticated. But because of our background and the things that we’ve done outside of the private lending space, we really do try to be kind of a partner with them. Not in the legal sense, but if we see something. We recently had a situation where we had a borrower that came to us in the city, had inadvertently overcharged them about 300 and some thousand dollars for permits that they weren’t allowed to do by law. And it was actually our land use consultant that picked up on it. And we went to the borrower and said, “Hey, by the way, did you know that they can’t do this? And here’s the law.” And then we put him in contact with an attorney that handles that kind of stuff. And they ended up going to the city and they ended up saving over 300,000 dollars.

Kevin Kim:

That’s so much value. I mean, that borrower must be thanking you guys. Because that could have jeopardized the entire deal.

Michael Schumacher:

I mean, they had it in their budget, so they were already accounting to pay the extra $300,000-

Kevin Kim:

But they were out of compliance?

Michael Schumacher:

But well, they just didn’t have to pay it. So that just went to their bottom line, an extra 300 grand. And so for us, we’re very kind of on a consultative basis. We’re not just trying to, “Here’s the loan and it’s a commodity and good luck.” We do have something to offer on the land development side.

Kevin Kim:

Yeah, there’s a value add component there that you’re not going to see with your traditional construction lender. That’s interesting, because with that component, I would imagine then a lot of your business is repeat business.

Michael Schumacher:

Mm-hmm (affirmative), yeah.

Chris Meinhardt:

And back to the turning down loans side, it depends a lot on the brokers you deal with too. So we deal with a lot of great brokers, who give us a good package. And they’re not going to pass a deal onto us if they know that it’s an issue or it’s garbage. So the broker and their creating or getting information together, putting it in a package for us, it’s huge.

Kevin Kim:

Yeah. And that goes to, I guess, length of experience and also understanding… There’s a level of underwriting that brokers need to understand how to do. And that goes to handholding and being willing to talk with them and show them. And are you guys training new brokers that come your way and say, “This is how we do things and that is what do we want to see from you in the future,”? Is that what you guys are doing with the brokers? A new broker comes to you, like…

Chris Meinhardt:

We have not done that. Most of the time, we don’t need to. But it’s just a lot of asking questions.

Kevin Kim:

Okay and then they’ll pick it up.

Chris Meinhardt:

Then they pick up that right, I need more information.

Kevin Kim:

Makes sense, because that seems to be also an interesting challenge both with, I speak with a lot of Wall Street aggregators, and also a lot of lenders who are primarily broker driven. And the biggest complaint is, the data sets are awful. Every time, it’s a different data set. And training people to give you the right package is a very challenging issue. Cool, okay. So I want to ask you guys a question because you guys have very interesting backgrounds in real estate, both in commercial and resi. I’m going to ask this for both marketplaces because this is unique to… We don’t get this opportunity a lot. First on resi, okay? On residential, I always ask this on the show, bullish, bearish, the next three years in private lending, what are your thoughts?

Michael Schumacher:

I’m bullish in the next two or three years.

Kevin Kim:

Two or three years.

Michael Schumacher:

Yeah, just because I think that the demand is still there and supply has not caught up yet. I don’t really know beyond that.

Kevin Kim:

Well, who does?

Michael Schumacher:

Yeah.

Kevin Kim:

I mean, three years is kind of far anyway.

Michael Schumacher:

I don’t even know at three years really. But yeah, what do you say?

Chris Meinhardt:

Yeah, I agree.

Michael Schumacher:

I’m bullish-

Kevin Kim:

For residential?

Chris Meinhardt:

Mm-hmm (affirmative).

Kevin Kim:

Okay. Now, let’s switch gears. Commercial real estate. I just got back from a crush show, that’s interesting. I’ve never seen that many… All the agency guys that are normally there didn’t show up, a handful of them were there. A lot of bridge guys, a lot of construction guys. Not as many agency guys as you think. And a lot of the big shops couldn’t be found. CBRE wasn’t there, so it was interesting. And I was a little bit concerned as I walked away from the show. I was bullish on the bridge stuff and the construction. I don’t know, what do you guys think? Multifamily was huge still. I mean, [crosstalk 00:55:54]. But that’s not…

Michael Schumacher:

Yeah. I’m bullish on the construction side, the bridge side, but new product, maybe other than industrial, not so much.

Kevin Kim:

Retail, office. All of the conventional asset classes.

Michael Schumacher:

Yeah.

Kevin Kim:

What do you think?

Chris Meinhardt:

Yeah, I agree with that. We feel a lot safer in the residential right now. I mean, everyone has to live somewhere. And with what’s going on with office, with COVID and people working from home and then the retail side too, it’s a lot riskier and we’re a lot more careful when we’re underwriting that.

Kevin Kim:

Let me ask you guys this, because you guys are dealing with this more frequently than most of our guests do, is I’ve always wondered, well, if it wasn’t for zoning, why couldn’t we just convert a lot of these offices? You basically just have wire frame buildings. Why can’t we convert these things into condos, or apartments, or industrial, even like light industrial, or some something else? Because there’s so much office out there and no one’s going to work anymore. They’re just working from home or they’re switching gears and they’re going to a smaller location. I mean, are you guys seeing any conversions happening with some of the… Or hotels.

Michael Schumacher:

So we have a loan on a property downtown, Mammoth.

Kevin Kim:

Mammoth? Okay.

Michael Schumacher:

Mammoth and great property, very centrally located. And the developer is converting that office building into a hotel project. So not multifamily, but it’s a conversion.

Kevin Kim:

That makes sense for a ski town, 100%.

Michael Schumacher:

Yeah, yeah. Adaptive, reuse type project. So we’re starting to see-

Kevin Kim:

Okay, we’re start to see that?

Michael Schumacher:

Yeah.

Chris Meinhardt:

Okay, good.

Michael Schumacher:

We’re also seeing some developers who are buying office buildings so they can get them retitled for multifamily-

Kevin Kim:

Now, are being much more understanding with this? Like California, it’s so hard to get permits. But I’m sure they understand how office is dying. I mean, is that playing a factor or is it still really slow, really challenging?

Michael Schumacher:

Well, in the state of California, the state comes out with these arena numbers, basically how many residential units you have to each city. It basically starts with each county just to produce-

Kevin Kim:

I’ve heard about this and this is partially why we don’t have it.

Michael Schumacher:

Right, right, exactly. So then the state comes and says to each county, says, “Hey, these are your allocation, you need to produce 10,000 units over the next five years.” And they have basically five year bands. Then the counties go to all of their cities and they make allocations and they distribute. They say, “Hey, this city, that city, whatever, based on your land use, this is what you have to produce in terms of housing.” In the past, the state has been a little bit hands off on it, where they’ve said, “Hey, really, what you need to do is have land that’s able to be zoned for residential,” an enabling sort of perspective. But because of the housing shortage, they’re becoming a little more aggressive. And they’re saying to cities, not only do you have to just rezone land that allows for residential, but you got to start to build. You got to start to have programs in there. You have to streamline your permits. You have to make it a lot easier for-

Kevin Kim:

So the state is demanding it get better.

Michael Schumacher:

They are, however, until somebody-

Kevin Kim:

Pricing for California.

Michael Schumacher:

It is, but the real-

Chris Meinhardt:

They’re not making it any easier though, that’s-

Michael Schumacher:

They’re not. But CEQA, California Environmental Act, until there’s CEQA reform, it’s probably not going to speed up very quickly. Because what happens is these developers, they can maybe get through the process quicker at the city level, but then they’re met at the end with a CEQA challenge and then they’re tied up in court for three years and now we’ve got a delay.

Kevin Kim:

Right, right, we saw that happen. In my back yard we had a wonderful, wonderful multifamily project and it just died basically on a vine and they finally finished it. They finished it the tail end of COVID, but it was sitting there for two years just like, “What the heck is going on?” And you started having homeless people just camping out there on the construction site. It was terrible.

Chris Meinhardt:

Well, and a lot of times the number of units ends up getting reduced because of CEQA and-

Kevin Kim:

And [inaudible 01:00:02].

Chris Meinhardt:

And then, so in order to make pencil, you have to put in luxury units. And then we have this issue of affordable housing.

Kevin Kim:

I’ve heard about this, yeah. Yeah, yeah. Yeah, yeah.

Chris Meinhardt:

And so the state’s doing that too. They’re coming down on cities who don’t have enough affordable housing, but it doesn’t pencil high-

Kevin Kim:

They got to penalize you for not building enough affordable housing and they go to campaign on that. But yet, the laws that they put in place make it impossible.

Chris Meinhardt:

Exactly, yep.

Kevin Kim:

Thanks, California.

Michael Schumacher:

It’s a challenge for sure, yeah.

Kevin Kim:

Well, you know what? I am still optimistic though, because we do need more houses here in California. And if we’re heading in that direction, at least the motivation is there. Hopefully they can loosen up laws a little bit, because I would love to see some of these office buildings and hotels be converted into apartments and condos. I think it’ll be great for the communities and continue us on this bullish cycle in residential too.

Michael Schumacher:

Yep, absolutely.

Kevin Kim:

All right, I think that’s all the time we have for today. This has been a really great one because we got to talk about California law and California building. And I never get to talk about building things on this show because we were talking about lending and mortgage industry. But this has been great. We talked about construction, and permitting, and thank you guys for joining us on the show today.

Michael Schumacher:

Thank you.

Kevin Kim:

And this is Kevin Kim signing off, Lender Lounge. See you guys on the next one.

Thanks for listening to Lender Lounge with Kevin Kim. I hope you’ve enjoyed this episode as much as I did. If you did enjoy, please leave us a five star review on your podcast platform. And be sure to follow our show to be notified of new episodes. If you’re on YouTube, don’t forget to smash that like button and hit subscribe for more content from all of us here at Geraci, Lender Lounge with Kevin Kim is available on all podcast platforms. Referrals really help us spread the word, so please send this over to someone you think might enjoy it. See you next time. This is Kevin Kim signing off.