Thank you to our sponsors for this episode, Liquid Logics and Spiegel Accountancy Corp.

Liquid Logics

This episode is sponsored by Liquid Logics, a NextGen FinTech company offering the only true full cloud based SaaS Loan Management System. The system includes CRM/lead pipelines, LOS full workflow, processing, automated credit & underwriting, servicing, reporting, closing DOCS, and 3 types of fund pool management structures. Although loan origination software is their bread and butter, at their core, Liquid Logics is a business solutions company dedicated to facilitating growth, minimizing your workload, and making your business the best it can be. Visit liquidlogics.com to learn more.

Speigel Accountancy Corp.

This episode is sponsored by Spiegel Accountancy, a national professional accounting firm, specializing in tax, audit, and fund administration, with over 20 years in the private lending space. Using an industry expert allows the fund manager to ask tough questions, such as, what are the accounting and tax impacts of loan loss reserves, delinquencies, or foreclosures? As a trusted CPA source for the private lending industry, Spiegel ensures clients’ financial reporting meets the highest standards. For more information, head to their new website at spiegel.cpa. Spiegel is your strategic and innovative accounting partner.

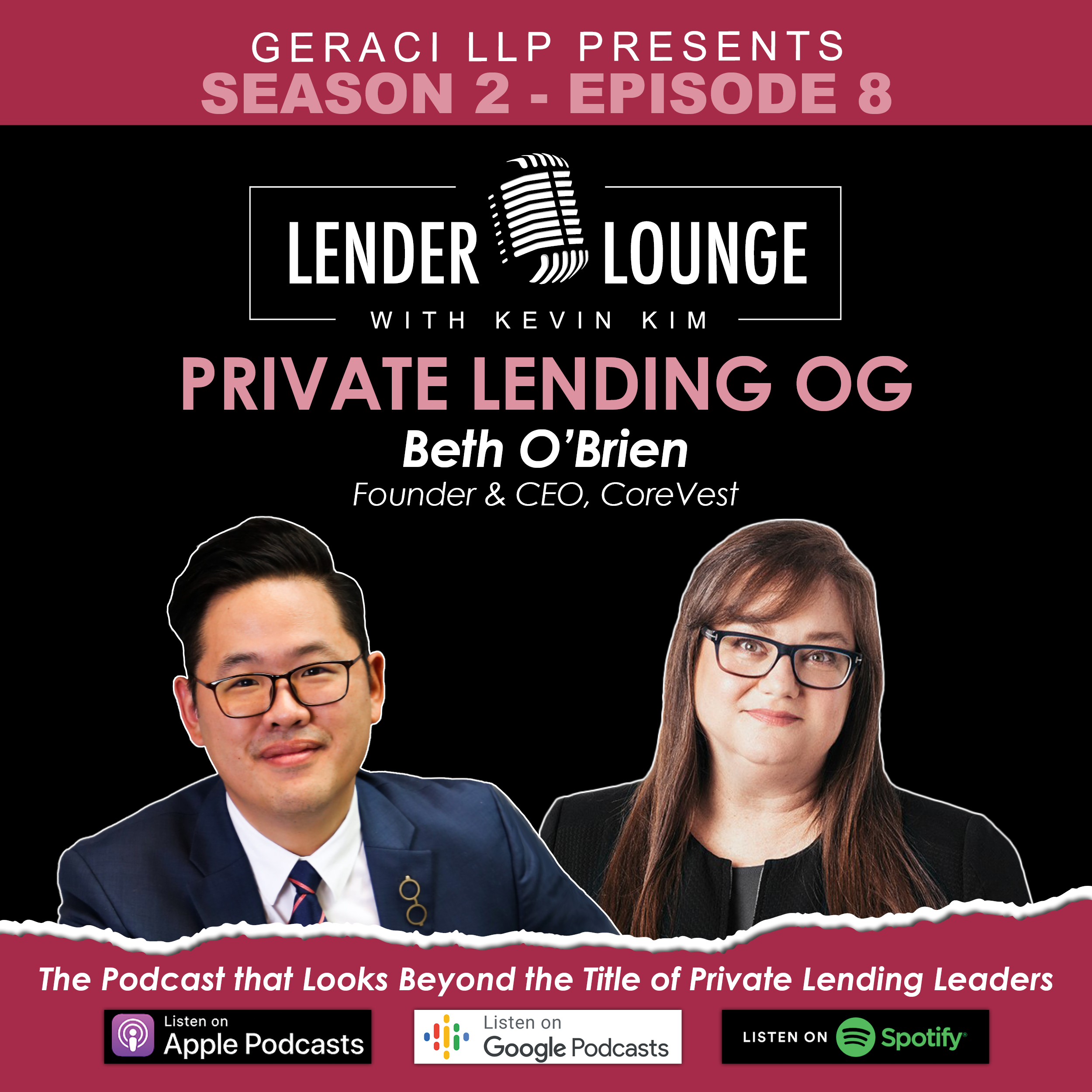

You’re listening to Lender Lounge with Kevin Kim, a podcast dedicated to the private lending industry. I’m Kevin Kim. And my goal is sit down with key figures in the private lending industry to talk about their business and their personal lives. We’ll get their takes on market conditions, the industry at large, and their personal stories. Overall, I really want to learn more about how they started and grew their businesses. So whether you’re a lender, a borrower, be a vendor, an investor, or anyone just interested in learning more about private lending, this podcast is definitely for you. Thanks for tuning in and enjoy this week’s episode of Lender Lounge with Kevin Kim.

Kevin Kim:

All right, guys. Welcome to another episode of Lender Lounge with yours truly, Kevin Kim. Today we have a very special guest, Beth O’Brien with CoreVest. Beth, please introduce yourself to the audience and tell us a little bit about the company.

Beth O’Brien:

Great. Hi, I’m Beth O’Brien, I’m the CEO of CoreVest, and I was kind of expecting at Lender Lounge that I would get a little jazz or something, like some background music, but I guess we’re not going to get that, right?

Kevin Kim:

Oh, you’ll get a nice guitar riff when we start the show.

Beth O’Brien:

When we start? Okay, good.

Kevin Kim:

We have all that great stuff set up.

Beth O’Brien:

I want to feel like I’m in a lounge. I was going to come with a cocktail, but…

Kevin Kim:

We should do that.

Beth O’Brien:

I figure we should be serious for this, because I’m very, very serious. No, you’ll see that I’m not. Look, I started CoreVest almost eight years ago now. It’s pretty amazing actually. And it was coming from having started another private money lender, that people thought I was really early on, in 2011. So I’ve actually been doing this for 11 years, which for me doesn’t seem like very much time because it’s been so much fun, but-

Kevin Kim:

Gone by, right? It’s just flown by.

Beth O’Brien:

Yeah. In this particular space, that’s like OG status.

Kevin Kim:

Oh yeah.

Beth O’Brien:

In a really bizarre way.

Kevin Kim:

10 years now, it’s 2021. [crosstalk 00:03:56] came out in ’11. I mean, private lending is like dog years. It’s crazy.

Beth O’Brien:

It really is. And it’s funny, I used to say to my husband, “Wow, there’s a revolution once a year.” I think it’s actually once a quarter right now. So whatever we say today is going to be out of date by next quarter. But that’s one of the things that keeps me so excited about the space is that-

Kevin Kim:

That’s true.

Beth O’Brien:

It, iterates nonstop.

Kevin Kim:

It’s very dynamic.

Beth O’Brien:

And so it was, I think a great idea at the time. A lot of people have had the idea, people have come in and out, but it is so clearly an important part of the market now. And I think my thesis then, which is still my thesis, is that this is really an important asset class and it deserves its own financing, and it really didn’t have it. There was commercial, there was private enterprise-

Kevin Kim:

So I want you to give us the 30,000 foot view of CoreVest today. And we’re going to go into that, 2011, your thesis and all the evolution, but we still need to-

Beth O’Brien:

Oh, sorry, sorry, sorry.

Kevin Kim:

What does CoreVest currently… I know you’re a private lender, we know you’re a household name, but you got to give us the 30,000 spiel real quick. Elevator pitch.

Beth O’Brien:

Yeah. 2000 feet… 20,000 feet, sorry. I’m so granular that 2000 is my 20,000. Sorry about that. If you knew me, you would know just how granular I am.

Kevin Kim:

Oh, this is good. We’re going to have fun with this one, I can tell.

Beth O’Brien:

So here’s the thing about CoreVest. We focus maniacally on originating private lender loans, and really being in the market. And we can get to that in the evolution of the company, but what we really believe, we have a bunch of people in the company, a lot of DNA, that is actually investors. Our COO was in charge of acquisitions at Colony American Finance, he bought the first 20,000 homes. This is something we personally have done, and I was also very deep into that space. So manically focused on the front end. And we have our own system for sourcing, underwriting and closing those loans. We don’t sell. We securitize our own loans just to match fund, or we balance sheet the loans, all of our bridge loans are currently balance sheet. And I still own, my intent on the day that we are sourcing and closing that loan is that we own it the day that it pays off or refis. And we do. And so we are, I believe, the largest or maybe the only private lender in the space who is really cradled to grave, who is the portfolio manager on the loan-

Kevin Kim:

On your size, I would agree. I think at the size that you guys are currently, how big is the company now?

Beth O’Brien:

We have everything on our balance sheet, it’s $4 billion. I mean, it’s actually a very large number, because we’ve never been a seller. If you were in one of our early securitizations, I still hold the first lost piece on that securitization.

Kevin Kim:

But that’s an interesting thing. So $4 billion now? I mean, I think it was… What was the number we were talking about last time?

Beth O’Brien:

Oh no, I’m saying that’s what’s on the balance sheet because things pay off. No, no, no, when I’m saying how much-

Kevin Kim:

In origination [crosstalk 00:06:57].

Beth O’Brien:

Oh, it’s around $12, maybe $12-

Kevin Kim:

$12 billion in originations in… CoreVest was founded in ’14, correct?

Beth O’Brien:

Correct. The very end of ’14. So the very end of ’14.

Kevin Kim:

Right. So ’15 ish. So ’14, that much-

Beth O’Brien:

First securitization was 2015. The first [crosstalk 00:07:18] was ’15.

Kevin Kim:

So a lot of our listeners didn’t know that. I’m glad we discussed this. CoreVest at its core is still a retail direct origination shop. You are not a, quote unquote, Wall Street aggregator.

Beth O’Brien:

We do not off-sell. Yes.

Kevin Kim:

You’re not a buyer or a seller [crosstalk 00:07:37].

Beth O’Brien:

We have purchased loans opportunistically. We do. It’s a small percentage of what we do.

Kevin Kim:

Your primary business model is not.

Beth O’Brien:

Primary business model is direct origination and then hold. If you were with me in 2015, with the first five year loans we did, they just paid off this past year. We had two bonds pay off in the past year. And I was still holding 100% of the risk on both bonds.

Kevin Kim:

And that’s something that the audience also needs to understand is just because a company securitizes doesn’t mean they lose control. If you’re the one controlling securitization-

Beth O’Brien:

If you’re the first lost piece, you’re still holding all the risk of the securitization. We securitize to match fund, not to offload risk.

Kevin Kim:

Credit risk transfer’s still there. It’s definitely something that’s a balance sheet play. All right. So now we have an understanding of CoreVest current business, and lending-

Beth O’Brien:

I think of myself as a portfolio manager. What I’m trying to do is generate high quality assets and be the portfolio manager of those assets.

Kevin Kim:

Right. Now, what asset class? Because this is what CoreVest is known for today. You guys are probably what I consider [crosstalk 00:08:42].

Beth O’Brien:

So we are a full life cycle. Yeah. We’re a full life cycle lender, which I think is not as well known maybe, is the fact that we do the-

Kevin Kim:

Construction [crosstalk 00:08:54]. Bridge.

Beth O’Brien:

We do the construction. We don’t really call it bridge loans. We call it the short duration book, which is bridge loans, but a lot of it is… It can be different strategies. It’s kind of six or seven different strategies that we do a lot of build to rent in the bridge book, which is basically a construction loan. We do a lot of renovate to rent, which is the other strategy, is the more diversified strategy of putting people in, but it’s still aggregation. And it’s still value add along the way. But we also do fix and flip and always have.

Kevin Kim:

And you’ll do that [crosstalk 00:09:31] across the country. And you’re also very well known for the DSCR five year end long term product.

Beth O’Brien:

Correct.

Kevin Kim:

And so really, cradle to grave lender as well. You can pick a builder.

Beth O’Brien:

Yeah. So 45% of our bridge book perms out into one of our longer loans. So those clients are with us because there’s more than one product that actually suits their needs.

Kevin Kim:

Right. Now, let’s take that historical step back and it’s now 2011, and you came out of Wall Street. You were at Goldman?

Beth O’Brien:

Yeah. So I was at Goldman for years, for about 10 years. And then I was at Citi. I was at Goldman doing only commercial and mostly commercial distressed, a lot of commercial loans, all commercial activity. Then at Citi-

Kevin Kim:

What year, was it in the 90s?

Beth O’Brien:

Yes. Yes.

Kevin Kim:

Oh, so you were heavily involved during like the Asian debt crisis and…

Beth O’Brien:

Yeah. In fact, two of the biggest transactions I worked on were buying directly from the Thai government, buying directly from the Korea, government, all the distress loans.

Kevin Kim:

Oh man. You and I should talk privately about that.

Beth O’Brien:

Yeah. We were the first-

Kevin Kim:

My family… We have a lot of stories to tell about the IMF crisis in Korea.

Beth O’Brien:

So we made a large investment when I was at Goldman in Kookmin Bank, and Camco was running part of the bad asset sell in there. So I spent a lot of time in Seoul investing in Kookmin Bank.

Kevin Kim:

Seoul in the ’90s during the IMF crisis. It was a very interesting time.

Beth O’Brien:

Yes. And the early 2000s. So yeah, I was there for a while.

Kevin Kim:

Nice.

Beth O’Brien:

Very, very fascinating. Anyway, so I spent a lot of time working-

Kevin Kim:

Yeah. That’s a totally different world.

Beth O’Brien:

Totally. And all distress loans. Although, what’s interesting is I built a lot of those companies from scratch. So if you’re familiar with the crisis at the time, there was no such thing as a secondary debt market. There was no such thing as a special servicer. So I literally built our loan servicers from scratch in Bangkok and Seoul so that we could-

Kevin Kim:

So you’re doing a lot of the process building from… It was a new venture that they were going at.

Beth O’Brien:

Exactly. And so I did a lot of the fundraising and we brought in clients and we had proprietary money in it as well. But actually setting up all the infrastructure in those various countries to deal with the loans was something that I worked on and set up a lot of these things from scratch. So I’ve been almost my whole career, I think of myself as a business builder. Someone who walks in, sees an opportunity, usually associated with loans; but everything in terms of the servicing, the systems, the due diligence, is something that I was helping to architect, and then would sit on the boards of these companies, like I sat on our Thai servicer for a while, I was in Bangkok once a week for these board meetings.

Kevin Kim:

But the idea of servicing didn’t really exist in-

Beth O’Brien:

It did not exist in Bangkok, no. Did not exist there.

Kevin Kim:

So you have to teach them, “This is what you’re supposed to do…” Literally at a granular level like, “Person, you’re supposed to collect payments and you’re supposed to do this, and you’re supposed to…”

Beth O’Brien:

This may be too much for your listeners, but it’s actually a really good… It informed the way that I think about lending, business building, if that’s what people are interested in.

Kevin Kim:

Yeah. But there’s a good analogy there though.

Beth O’Brien:

When we were building the servicer in Bangkok, we were the first winners of a distress loan pool that the Thai got; the FRA, which was the Thai restructuring company was selling. So of course, I mean, as all of us business people know, when you have an auction and you’re the winner, it messes with your mind a little bit. You want to win because you’re bidding on the assets, but you know you’re the high bid. So there you are, you’re the high bid on a billion dollars in BOT loans, and there’s no such thing as a servicer in Thailand. So you set one up, and it’s Goldman Sachs and we’re trying to look for partner. So we got into business with GECC, which had a Moped servicing company, Moped loans-

Kevin Kim:

Somewhat similar.

Beth O’Brien:

Okay, it was the closest thing we could find, Kevin, okay? We’re like, “Moped loans, real estate loans, they’re pretty similar.”

Kevin Kim:

Yeah. Yeah.

Beth O’Brien:

So we do this joint venture with GECC, which is market leading. Goldman Sachs, arguably market leading, even though we’d never purchased there before. We set up a company from scratch, we’re going to the operating companies of the firm at four in the morning and doing our pitches, we get everything… Everyone’s assuming we’re ticked and tied, we have an army of people working on this. So we open up our doors, we have a hiring fair, we have all these procedures. We open our doors at like nine o’clock in the morning in Bangkok, in our brand new offices. And people just start showing up with bags of BOT, like literally bags of cash. And we had set up everything, because we were so American. Or at least our institutions had, even though we were all working in Asia and we had all these institutions, we’d set up everything, we figured we were going to get checks, wires, credit cards, whatever people pay their mortgages with here.

Beth O’Brien:

No, everyone was so excited. They’d heard this pool was bought at a discount. No one had ever offered them a discounted payoff before. And they literally showed up with so much cash we had to shut the company down within an hour because we physically couldn’t store the cash, it was so much. And it was so dangerous. So we had to shut the entire company down and start again in two days with armed guards, Brinks trucks, and all these cash… We had no procedures in place for cash. And so what it does is it reminds you that no matter how much work you do to set something up, you can have whatever thesis you want, you can have whatever idea you want to start a company, you are going to make some big mistakes. The key is, can I react fast, can I figure out what my mistake is, and can I adjust and move on? And it wound up being a very successful venture, but we had to completely rethink and not be wed to, “Well, we set up these procedures and they’re going to work.”

Kevin Kim:

And how much of that was improvisation? Because the two day turnaround, you have a two day turnaround.

Beth O’Brien:

Two day turnaround, we were back up and running and we had everything we needed.

Kevin Kim:

Right. So the idea of improvise, adapt, and overcome. Having to improvise that, “Okay, well we have all this cash. What do we need?” The idea of having to think on your feet. And it’s fascinating to hear an entrepreneurial mindset at an institution. I think that that does work [crosstalk 00:16:09].

Beth O’Brien:

Particularly those two institutions. I mean GECC is like six sigma stuff.

Kevin Kim:

Right, right, right.

Beth O’Brien:

Which is fantastic, but I think it’s a really highly skilled organization, but to be able to react quickly even within those organizations is key. And so you take that to starting a private lender or starting another business, what I always tell people is, you will make some big-ass mistakes right away. Embrace them. That’s okay.

Kevin Kim:

Yeah. That’s one of the-

Beth O’Brien:

Just react fast enough and don’t [crosstalk 00:16:40].

Kevin Kim:

The quotes that I live by is about how enthusiastically you can get back out after you fail. I mean, that’s what the definition of success to me is. So how does one transition from distressed corporate credit and mortgages and commercial and working with the governments of Thailand and South Korea, and then all of a sudden jumping into the residential mortgage space in the United States? Very different markets.

Beth O’Brien:

So here’s what happened. Right, very different. So I came back, and it looks really non-linear, my career, except now it looks like I did it on purpose. I came back, I wound up going to Citi on the residential desk, even though I’d never really dealt with residential mortgages. But I had a close friend and they were looking for somebody, went in, I thought I would just interview, and wound up getting this job. So I actually spent the early part of the mortgage crisis on this mortgage desk. Now, because I had done so much distress work, all of a sudden when everything fell apart; I mean, everybody on that desk was much smarter than me, much better at structuring cash flows, much better at everything that you’d think of as a resi mortgage desk. But I was the only one who knew how to foreclose on a property, get ahold of the assets, what a third party sale was. I already knew from distress. And the residential market had never really seen that type of distress. I knew how to consolidate servicers. I knew how to-

Kevin Kim:

And that scale either. I mean… Oh my God. Yeah.

Beth O’Brien:

Right.

Kevin Kim:

Because that was something that you’d usually third party, right? The institution typically third partied everything.

Beth O’Brien:

Everything, except for like the cashflow modeling of the things… Nobody really expected individual mortgages to be important. I was that person who, if you watch The Big Short, was always like, “Aren’t we going to site visit? Shouldn’t we drive the assets?” I was so used to the commercial mindset on distressed assets of touching each asset and seeing each one. And so when the crisis really hit at Citi and so much of the desk was gone, all of the bad assets came to me. So all of a sudden I was managing down the rock pile of like $4 billion of bad assets. Dealing with the treasury, working through the… And I wound up working through auctioning off assets, because we couldn’t sell the REO fast enough, it was like a falling knife.

Beth O’Brien:

Which is how I got associated with auction.com, and I wound up being one of their bigger clients. I gave the reference when they took an investment from the outside. And then a couple years later when they decided to do a loan sale program there, I showed up on both the screen from auctions perspective and from their private investor, because they had spoken to me at length about when they made the investment. And so I wound up going there to start their loan sale program and started AuctionFinance. We saw in the auctions that there were all these people on the steps, all these people trying to buy the real estate, but the debt capital markets hadn’t caught up yet.

Kevin Kim:

No. I mean, it didn’t exist.

Beth O’Brien:

But it’s all equity.

Kevin Kim:

Yeah [crosstalk 00:20:24] it was 100% equity back then. And if it was debt, it was your friends and family type.

Beth O’Brien:

All friends and family.

Kevin Kim:

The true hard money from back in… Yeah, that’s what it was like. I mean, we have plenty of clients that started the business that way.

Beth O’Brien:

So we had this thesis that we got half the money from Stone Point Capital, which was the main investor in auction.com and then Starwood through LNR, which was one of their close relationships on the commercial side. And we started a private money lender mostly to help facilitate the sales at auction.

Kevin Kim:

And what year was this?

Beth O’Brien:

This was in 2011.

Kevin Kim:

Wow. So was this the birth of…

Beth O’Brien:

Right. I had called around. I called around to a bunch of other private equity at the time. I’m like, “Are you guys interested in coming in?” Because we were clubbing it up. AuctionFinance wasn’t 100% auction.com. And everybody was like, “Wow, Beth, interesting idea, but so early.” People were shocked that we were going into that debt lending that early, but it was quite successful.

Kevin Kim:

And this is a common theme on this show. We discuss us like when Wall Street started to look at the space, and we know that generally speaking they jumped in in around ’14, ’15.

Beth O’Brien:

Yeah.

Kevin Kim:

But you’re raising an interesting point, because of your history and your previous career, you were able to solicit Wall Street investors, institutional investors, as early as ’11. What was it? It couldn’t have been yield. I mean, yield was high back then, but it couldn’t have been…

Beth O’Brien:

It was not yield. In fact, at the time I was convinced I was going to do 10 in two across the board, which was actually really light to market at the time.

Kevin Kim:

Yeah. Yeah. [crosstalk 00:21:59].

Beth O’Brien:

It was actually light. It was like a 12% market. It was like a 12 and three-

Kevin Kim:

On national average, 12 and three is about right, yeah.

Beth O’Brien:

I had this very flat rate. I had this whole idea of doing it very cookie cutter. I’ve always been somebody who tries to do things in a way that scale. Our chief operating officer likes to call it burger, fries, and shakes.

Kevin Kim:

Yeah. I heard you say that when [inaudible 00:22:20] interviewed you at one of our conferences. And I want to talk about that. So this early on…

Beth O’Brien:

That’s really important to getting things smooth. I’m really about no friction. But that’s a whole other…

Kevin Kim:

A simple standardization, every time every loan’s going to look and feel-

Beth O’Brien:

Everything’s modular, every piece of paper… You’ll appreciate this as a lawyer, every one of my docs is the same, unless you want to get… I do things in a very prescriptive way, so that when we get to securitization we’re not redoing everything.

Kevin Kim:

Right, you’re planning, way, way, way, miles and miles away.

Beth O’Brien:

Right. I’m doing stuff at closing that affects my securitization asset management. People are not as…

Kevin Kim:

Yeah. It makes it smoother for everybody. And that makes it easier to hire, makes it easier to train. I mean, that’s fantastic. But this is funny because you’re thinking of this in ’11 when the market barely existed.

Beth O’Brien:

Barely existed. It was me, it was Gregor Watson, who was doing this at 643 Capital, and Robert Wasmund who was doing it at Genesis. The three of us were like, it. There were plenty and plenty of people doing it, lots and lots of people doing it in their markets.

Kevin Kim:

Yeah. At the local level, at the courthouse steps.

Beth O’Brien:

But we were the only ones who were doing it more than one state, more than one location.

Kevin Kim:

Right. Because even the larger retail operations that were kind of funded through high net worth investors and had their funds, the ones that we’ve known over the years, have talked about their experience in 2011 in very much being a, you just kind of make it up as you go, kind of scenario. And there was no consideration of standardization back then because every deal was so different. But you’re coming to the market in ’11, not only with institutional capital, but also standardization. And that was it. The institutions were okay with it because you’re going to standardize it for them. You’re going to make it [crosstalk 00:24:09].

Beth O’Brien:

I’m standardizing it. I was willing to do reps. I remember I had somebody come on site for a warehouse line; remember, warehouse lines were nonexistent for this product at that time. And I had somebody-

Kevin Kim:

For many, many years to come. Yeah.

Beth O’Brien:

And I had somebody come on site, one of the three main money center banks was willing to do it, came on site and they’re like, “Wow, Beth, you have a custodian.” I had my dots at the custodian because I grew up in an environment where you would do stuff like that. Your average hard money player was not, they didn’t even…

Kevin Kim:

You weren’t thinking about that kind of stuff.

Beth O’Brien:

They weren’t thinking about the custodian.

Kevin Kim:

Yeah. I mean, not just custodian, but being willing to make reps and warranties, being willing to commit to certain production qualifications, understanding the fee structures. It was a kind of a growing up of the industry. Today, it’s all kind of foregone.

Beth O’Brien:

No, I was already diligencing for securitization reps in 2011, even though I’d never even done a bridge loan securitization. But I would never make a loan that was unsecuritized.

Kevin Kim:

What did you guys call the assets when you’re talking to the institutions back then? Because to them, the challenge that I’ve heard other lenders tell us about was they didn’t quite understand the asset class either. It wasn’t a conventional mortgage.

Beth O’Brien:

Yeah, we were basically calling it fix and flip. In fact, we were so focused on the takeout… As a lender one of the things that’s really important to you is, are you going to get paid back? Because on a good day, on your best possible day, Kevin, you get par. Congratulations, you were perfect, you get par. You never get par plus. So you got to make sure you’re getting paid back. And so we were really focused on takeout. We actually wouldn’t do rental loans. We had a policy against it at that time just because we didn’t know what the takeout could be for a rental loan. That market hadn’t developed yet. And so we really were only financing people that we could see the turn, like did they have experience actually selling the asset in the required period of time?

Kevin Kim:

So let’s talk about that. So this is now Colony, right?

Beth O’Brien:

Yeah. So at that point it was AuctionFinance early in 2011. So what happened was Colony was one of the people I went to for capital at the time who thought it was too early. In 2014 they called me back and they’re like, “Beth, remember when you came to us? We’re going to start a lender now. We now think it’s a good idea. Will you come and do it?” And I said, “No, I’m not going to California, but here’s three names of people who will be really great for you. I really like the job I’m in.” And then two weeks later, “No, we really want to just talk to you. Just come in and have a conversation.” I was like, “No, really, really…” Also proving another point. If you’re not interested, they really are interested in you.

Kevin Kim:

Yeah. Yeah. Wait, so 2011, 2014 is when the industry came out of the primordial ooze in my opinion, and we started to see some grownups coming to the space and the industries are really starting to get serious in ’13, ’14. And one of the interesting parts of that was AuctionFinance behind the scenes was probably shaping the stories for a lot of the lenders out there who were trying to compete at the courthouse steps.

Beth O’Brien:

Yes.

Kevin Kim:

We weren’t seeing a lot of like heavy, heavy, like nationwide marketing, nationwide expansion. But was AuctionFinance back then, were you a national lender even early?

Beth O’Brien:

I mean, I don’t know how many states you need to be in to be national, but we were in multiple states, both judicial and nonjudicial. We were doing it in Georgia, Florida, California [crosstalk 00:27:45].

Kevin Kim:

Right. Big market states.

Beth O’Brien:

Basically anywhere [crosstalk 00:27:47] assets. We were doing it in the larger market states. We weren’t as national as I am now, but only because-

Kevin Kim:

But that was foreign too.

Beth O’Brien:

We were following the auctions.

Kevin Kim:

Yeah. You’re following the auctions…

Beth O’Brien:

We were in Texas, we were at all the Super Tuesday events, we were at all of steps in California.

Kevin Kim:

So the market in ’14, so Colony’s asking you to come.

Beth O’Brien:

Remember, what happened in ’13 was that Invitation Homes did this first securitization on a loan, and all of a sudden the debt markets were like, “Ding, ding, ding, ding, ding. We can do this.”

Kevin Kim:

They finally realized it made sense.

Beth O’Brien:

“If we can do it on homes, we can do it on loans.”

Kevin Kim:

Right. It made sense to them. Everything started to make sense, started to gel.

Beth O’Brien:

So all of a sudden you see servers come in, you see Blackstone come in with B2R, and you see Colony come in on the theory that, “Hey, if we can do this at 100 cents on the dollar on equity and buy houses, how about we come in the stack at 75 cents on the dollar,” and by the way, with the same yield up front, because we don’t have to put someone in the house, you’re yielding on day one. So you’re lower in the risk profile, but all of a sudden you’ve got this very equal yield. Now, you’re captive par, you got to get it, you have to have credit, it’s not as simple as that, but it’s pretty close to what you would want to do. And so that’s why you see the people who were also involved in the equity come into the debt around 2013.

Kevin Kim:

And a lot of our listeners who are kind of newer on market entries forget is a lot of this was driven by former, and the current, massive home buyers or the iBuyers.

Beth O’Brien:

It was the fact that they were able to achieve the securitization, because the market wasn’t 100% sure you could securitize rental payments. Which is they didn’t actually securitize rental payments technically legally, but that’s the underpinning is the rental payment. They securitized a large loan-

Kevin Kim:

Yeah. I mean, at the end of the day it looks like one.

Beth O’Brien:

It’s the loan that got securitized, but it’s the rental payments that pay it.

Kevin Kim:

Right. And we saw a dramatic, I guess paradigm shift from ’14 to ’16 when now every institution and their mom was jumping into the space and buying up loans and doing everything they could. Tell us about your transition to Colony and then rebranding to CoreVest. Now we’re going from [crosstalk 00:30:09].

Beth O’Brien:

Colony called me because there was somebody that I had called along the way. I mean, that’s one of the nice things about being kind of in and around the space for so long is that, look, we all have conversations with each other. [crosstalk 00:30:21]. The opportunities present themselves because we do actually all know each other and have been doing business for years together. Which is one of the nicest things about this space is that it’s so collegial, and most of the principals really do know each other and can have these kind of calls. Anyway, so I wound up going to Colony, starting it from scratch. I actually shut them down right away when I first got there, because the first loan they did; this goes back to our other point; the first loan they did was a $3.2 million loan. Probably one of your listeners is going to call me out on it because it was his loan. But I think he paid in legal fees like $40,000 or $50,000, because it was a CMBS loan that had to have a non-con opinion and an enforceability opinion.

Kevin Kim:

On a residential property?

Beth O’Brien:

And everything that you think of in a CMBS loan. Excuse me?

Kevin Kim:

It was a residential property?

Beth O’Brien:

No, it was a portfolio of rental homes.

Kevin Kim:

Oh, really?

Beth O’Brien:

Yes. It was a portfolio of rental homes and that’s what it cost, and I get there, I’m like, “You cannot run a business this way.” I’m like, “The legal fees have to be like five grand.” They’re like, “Oh, it can’t be done, Beth.” I’m like, “Yeah, it can.” We have to figure out a way to make this work for the client, because it’s not a $30, $40 million CMBS loan. It’s at its core a small portfolio of residential loans, how are we going to make that work?

Beth O’Brien:

And so I went out and got 50 enforceability opinions for each state. I went out and got all of this stuff up front and then said, “Look, here’s a loan package that we can close with you that we think is reasonable that’s five grand,” because we did everything front. Now, if you want to negotiate, you have special circumstances, that’s fine, then we’ll just take a deposit for the legal fees, which is [crosstalk 00:32:10]. And so you never tell somebody it’s non-negotiable, but you give them something that works. And it’s not non-negotiable, you have a package that works and it has seven or eight riders that work if they need a certain type of thing that-

Kevin Kim:

You’re pre-planning it basically, you’ve already pre-planned any kind of random thing that usually comes up. And then if they want something bespoke, then…

Beth O’Brien:

Right. You may have a different type of bad acts carve-out, because you’re a fund than an individual, or something like that. And so what you do is you standardize enough opportunities and enough ways to do it that people are not paying for the friction each time. You’re still going to have all the valuations, it’s an expensive process to have a large [crosstalk 00:32:52] assets.

Kevin Kim:

And going back to the idea of burger, fries, and shakes, the idea of standardization, commoditization, pre-planning is something that a lot of people don’t think about. They kind of go into this thinking, they build as a reaction. So we see a lot of people build their systems and processes and software and protocols after jumping in-

Beth O’Brien:

Right. Whereas I shut it down, built it, and then started it back up.

Kevin Kim:

Right. So talk about that; I mean, was that partially one of the reasons why, or was it maybe a big reason why Colony, which became CoreVest, was able to scale? Which it did because you guys are now what I would consider definitely a household name, but you’re kind of the standard a lot of our clients are now shopping against and being shopped against. And the name always comes up, whether it be in the DSCR space or in be in the short term stuff.

Beth O’Brien:

I do think it’s because we know how to close these loans, and we close them in very reasonable periods of time with-

Kevin Kim:

You guys aren’t promising like a couple days, you’re doing it within a reasonable-

Beth O’Brien:

No, we don’t do it a couple days. A rental portfolio loan is going to take you 30 to 45 days. But it doesn’t take six months like some people do. And we’ve built a system. Our system, I think I mentioned earlier, really starts from the sourcing. Everything feeds the same end to end system so that no one is ever retyping anything, no one is ever doing something specially. What comes in, I can tell you on a closing date of a loan what Google word they used when they searched it.

Kevin Kim:

Oh [crosstalk 00:34:26]. So you’re not only streamlining and standardizing the production process, you’re also doing it for a lead generation process.

Beth O’Brien:

Yes. I also have a feedback loop directly to my lead, John, and my originations team.

Kevin Kim:

So they now know what’s working and what’s not.

Beth O’Brien:

Right. So we’re constantly… I’ve been told, and I don’t ever see any… But I’ve been told from warehouse lenders or rating agencies that we actually spend less on marketing than most people. But it’s because our marketing is so curated.

Kevin Kim:

No, actually I can tell you, from a person who’s very involved in the marketing in this industry, your guys’ average market, I see the AdWords stuff online, see how it’s structured. Your guys’ spend is nowhere near some of your competitors and colleagues, and what’s also-

Beth O’Brien:

But meanwhile, it’s providing higher lead gen.

Kevin Kim:

And so that has to do with you’re intentionally tracking every [crosstalk 00:35:28].

Beth O’Brien:

We have an almost daily feedback mechanism, even from a… I know when I get rating agency feedback what types of loans are getting me what levels, and what type of search was done for those.

Kevin Kim:

So the early on interface is feeding the tail end-

Beth O’Brien:

And the tail end is feeding-

Kevin Kim:

And it’s… Oh my goodness. Okay. Now, that insight is something that’s very valuable for a lot of folks who do not appreciate, I guess what I call data. They don’t appreciate the tracking of data.

Beth O’Brien:

I’m data obsessed, Kevin.

Kevin Kim:

And we know this [crosstalk 00:36:03] we know how granular you are.

Beth O’Brien:

I’m such a consumer, drives people crazy internally, because I am such a consumer of data.

Kevin Kim:

But it’s not… So when we talk about data on this show, a lot of people kind of automatically go to like macros and macroeconomics and regional [crosstalk 00:36:19].

Beth O’Brien:

Or purchase data. Yeah. Everybody who tells me they’re into data is talking about what they’re buying from the market or what they’re [crosstalk 00:36:26] records. Me, I believe my own data is my best data.

Kevin Kim:

So internal data-

Beth O’Brien:

I’m maniacal about my own data and I’ve got eight years of it.

Kevin Kim:

So that’s something that a lot of folks do not do-

Beth O’Brien:

And I built it in a way to capture the data because I’m so data obsessed. My systems were built in a way that I could capture the data.

Kevin Kim:

And it’s putting out reports for you constantly for you to make a decision off of them, but once again, I want to stress to our listeners, this is not like geographical macroeconomic data. This is not appraisal data.

Beth O’Brien:

No, believe me, I consume that too. I love seeing what other people are putting out. It’s not that I don’t read market data. But what I’m talking about is my own data. I have it milestoned in a way that I have dashboards that I can look at any time I want.

Kevin Kim:

So like loan production data, we talked about earlier, the SEO and the marketing-

Beth O’Brien:

But all the way through asset management, my asset management data, I know when a loan comes in, I know exactly which bucket is more likely to default.

Kevin Kim:

And it’s showing outcome.

Beth O’Brien:

I know what the characteristics are of my loans that have gone sideways. And I’m going to get that red flag on the front end.

Kevin Kim:

And most companies, one of the common threads that I’ve noticed, this is I’m guessing a bespoke, purpose built platform; I don’t want to say software, because it’s a platform-

Beth O’Brien:

Yeah, the platform, it is end to end, it is one single platform that I use all the way through. I have some visualization tools on top of it, like the platform is not the best at making the dashboard, so there’s plenty of things out there that can bring your data up and make pie charts, that kind of thing. But the system itself, I drive people crazy, I have a single source of truth. If it’s not in the system… And like I say, it’s the same system that has the lead gen and the asset management system and the servicing data and everything else comes into it. But it’s not that it’s a proprietary system. We’ve made it proprietary by building it out, if that makes sense.

Kevin Kim:

So you bought some kind of like open source or SAAS protocol.

Beth O’Brien:

Yeah. It’s a normal platform that anybody can buy, it’s just that I’ve customized it so much.

Kevin Kim:

Customized it to your needs.

Beth O’Brien:

Yeah.

Kevin Kim:

Okay. Well, that’s good news for our listeners, because a lot of people, when we hear about larger companies that have scaled to the size that CoreVest has, the conversation always kind of goes around the platforms that they’re using and the software and the tools and the hiring and that kind of stuff. The tool component, typically the story is that they built it themselves, because they [crosstalk 00:39:06].

Beth O’Brien:

Yeah, so I was against that, having been in a bunch of places, I felt it was important to have something that was 100% cloud-based. We went home for the pandemic in 24 hours notice, and there was not a hiccup because everyone was already on a laptop, all of our stuff was already cloud based. So that was built that way from the beginning. But yeah, no, it’s a totally, very normal system on purpose because I’ve seen too many places spend tens of millions of dollars building out a weapon system that works for the loans. But then like I said earlier in the program, it’s been a revolution every quarter. We’re doing different products and we’re doing different things than we were doing six years ago.

Kevin Kim:

To me, I feel like almost every month. Even within fix and flip, you see some variation thereof, and some random esoteric product coming out. I’m like, “Since when do we do this?”

Beth O’Brien:

I mean, take something really simple. We didn’t use to do renovation financing. The original fix and flip market, that was it. There was no such thing as another advance. ARV was not relevant. And so if you had built a system then, how would you have accounted for the extra draws and the extra this and that? And so that’s why I think it’s important to have, we actually have a, we call them agile sprints. If you’re into technology I think everybody knows that. Every two weeks we come out with a new version of our system.

Kevin Kim:

Yeah, yeah, you have to.

Beth O’Brien:

Literally it’s every two weeks. But that’s why we chose this system, because it’s flexible enough that we can do that. We also have a lot of portfolio loans. So we have a whole asset background and then a loan background. Many to one and one to many is going to cause you problems in a system if you haven’t built it that way from the beginning.

Kevin Kim:

And so the challenge that I’ve identified for a lot of our clients is they don’t have the ability to say no sometimes.

Beth O’Brien:

No, right?

Kevin Kim:

[crosstalk 00:41:09]. But the challenge is like, the loan makes sense to them and they want to make it work, and they’re still small enough where they can be esoteric. But then the challenging question, if you’re doing that more than once a month, how often does that keep you up at night or keep you delaying?

Beth O’Brien:

Yeah. That’s a fantastic, fantastic question, Kevin, because I think every one of us is really an entrepreneur at heart. And we want to do every loan. That’s why we’re here.

Kevin Kim:

Somehow it can make sense, right?

Beth O’Brien:

Right. I mean, look, you can always fix a bad asset. You can’t fix a bad borrower. So I don’t want to do the loan with a bad borrower, but I’m a fan of almost every asset if it has a strategy.

Kevin Kim:

So you’re building the burgers, fries, and shakes around that that fact pattern that’s going to come up.

Beth O’Brien:

Yeah. I’m hoping. I’m hoping I’ve got it. But I’m like I said, I change my system every two weeks. Driving me crazy. We have a little release every other Friday night.

Kevin Kim:

But when you do that sprint and you’re building out that new structure or product…

Beth O’Brien:

Maybe it’s just a new field, maybe it’s a product. It could be big or small, but everybody knows you only have change… We do it in a way that’s systematized. We only do it on Friday nights because we test over the weekend when people aren’t really closing loans. You don’t want to break your system on a Tuesday.

Kevin Kim:

That’s important actually. A lot of people-

Beth O’Brien:

And we have this whole set.

Kevin Kim:

Once again, though, it goes back to the idea of planning ahead. I think the big theme I’m hearing is not planning ahead for consistency. That’s what I’m hearing. And it’s something that’s almost unheard of in our sector. And I think as a credit to you guys’ success it’s taking you guys very far, because not only is i what attracted the institutions in ’11, which was unheard of, they weren’t going to do… But also what’s allowed you guys to scale at the size that you’ve been able to have, but that also questions-

Beth O’Brien:

Right. Without adding the human spackle.

Kevin Kim:

Okay. Yeah. And without having a giant workforce. And I want to ask you about that. So clearly when you came in and joined and I guess restarted Colony-

Beth O’Brien:

Colony. And then CoreVest was formed.

Kevin Kim:

And then CoreVest conversion. But the company must have changed. I mean, not just names, but have changed from a size standpoint. When you were early, it was what, you and three people? I mean, what was the company like?

Beth O’Brien:

Well yeah, we did start… There was one warehouse lender who said, “Really, we’re going to lend to them? They’re like three guys in a Bloomberg.” I was like “Two guys, one girl in a Bloomberg, okay?”

Kevin Kim:

Hey, you had a Bloomberg.

Beth O’Brien:

Had a Bloomberg, okay?

Kevin Kim:

You had the curve there. Most of us couldn’t afford a Bloomberg back then.

Beth O’Brien:

That’s five grand a month, that Bloomberg. Actually I was borrowing the Bloomberg from somebody else at Colony, but that’s another point.

Kevin Kim:

Hey, someone lent it to you at least. You had a friend that’s deep enough to give it to you. But that’s the thing, the company is three people, and that was not uncommon.

Beth O’Brien:

We were 20 pretty quickly. You need a lot of different functions. Although particularly Ryan and I, I’m like, “Are you the marketing department this week or am I the marketing department? Because somebody’s got to get an email out.” And we were the content people, we were the marketing people. I was head loan closer. They still call me in to… I can still close a loan if I have to.

Kevin Kim:

Nice.

Beth O’Brien:

But I think because we did that, it allowed us to really understand where some of the opportunities were when we were building out the scalable machine. When you’re building the foundation, because we were so ingrained in it at the beginning, kind of…

Kevin Kim:

But when you’re so small like that, and when you’re in startup mode, being adherent and being strict about those standards systems in the processes is challenging. And I’m the bad guy here at the office. I always deviate because I’m so bad at it.

Beth O’Brien:

We’re trained to say yes, Kevin. I want to say yes. I am a yes person. If you ask my CFO, he thinks I still say yes too much. But what it did for me though… First of all, our clients are also really brilliant and [crosstalk 00:45:32] and so by being head loan closer for a few months, I actually really learned from my clients. Like we’d be in these negotiations and I’d have these docs that some very important securitization firm had put together for me with all these different things in it. And I’d be coming to asking them, “I just had a conversation with a client and they don’t like this provision and that provision for the following reasons, and I kind of agree with them. They’re smart. They know what they’re doing in their business. Do I really need this? Is this really something I need for securitization?”

Beth O’Brien:

And we’ve been able to, I think because we dug into it, they’re still very complex documents, this is not an easy mortgage, but I feel like we’ve been able to take a lot of the noise out. And I actually credit some of my really diligent clients at helping me get there. Because we did spend a lot of time on negotiating these provisions and coming up with what I think is a clean set. And even things like when we first started, the insurance was crazy high, particularly in Florida, it almost made no sense to close certain loans with the type of insurance we needed. We spent so much time working with the insurance companies on coming up with a PML approach.

Beth O’Brien:

We’re like, “Look, if you have a CoreVest client, we’re going to have a whole pool in the securitization. If you do enough of this, you should be able to spread the risk over all of these assets that are really nationwide, that are cross collateralized, or they’re in these pools.” And we were really looking at it on a house by house basis. And we were able to bring down the cost of this, of the insurance dramatically by working with them on just making them try to understand the securitization process better. And so having both sides of this really, I think helped us make the front end a little more user friendly. I mean. I’m sure my clients would get on and say, “She’s not that user friendly.” It’s not perfect. We are the lender and they’re the borrower.

Kevin Kim:

I mean, it’s not automatic, whatever you want. But it’s fascinating when I hear about people who are very like standardization and scaling, combining that with that entrepreneurial “I want to say yes” mentality and balancing it. So when was the time when… I mean, currently how big is the company now? I mean, you guys have offices in New York and in LA, here in Irvine as well.

Beth O’Brien:

Yeah, Irvine, LA, New York, but we’re still about the same number of people, about 130 people and that’s end to end.

Kevin Kim:

That’s it?

Beth O’Brien:

Yeah. That includes my [crosstalk 00:47:59] leaders, that includes my capital markets group, and all the underwriters and asset managers in between.

Kevin Kim:

I thought it was a lot higher. Yeah. 130 is not as big as… I was actually thinking 200 ish.

Beth O’Brien:

Yeah. A lot of our competitors are.

Kevin Kim:

Yeah.

Beth O’Brien:

And I think it’s really a testament to the process and the systems we have in place as being scalable.

Kevin Kim:

So how do you guys, I mean, for lack of a better word, enforce these things? Because one of the hardest things with this stuff is, “You’re deviating, you’re deviating.” I do it all the time. People get mad at me for it. Because I joined the company when we were literally like five people and now we’re 30 or 40.

Beth O’Brien:

It’s not that it’s not that we’re not trying to innovate and deviate and have conversations and come up with something. But one of the things that I think makes us so successful and keeps our loans closing at a good rate and our total staff number is at a reasonable number is that once something gets into underwriting, it has a high 90s percentage chance of closing. So we do that type of work up front before it goes into the system. Once it’s in our system and it’s going through, it’s actually very hard, the underwriter can’t really deviate. Until there’s things in the system, you can’t get to the next step unless certain things come in.

Kevin Kim:

Okay. So it blocks them. Okay.

Beth O’Brien:

It’s managed in a workflow process and it has everything in one place. I mean, one of the things that’s so nice about it, we integrated at Redwood, they had already made a purchase of 5 Arches, and so we integrated the two teams. And I remember one of the women who came over whose job was just, I mean, something really simple like valuations, came over and said, “Wow, I’ve got two hours a day back.” Two hours. Because I think most people, I don’t think this is a ding on any particular firm, but most people, if you want to get valuations, you send an email with a list of 12 properties or 15 properties or however many it was and you say, “I need the following 12 evaluations.” Nine of them come back on time. And then you’re dropping and dragging into the folders to figure out which three you still need. And you follow up with a phone call and such and such.

Beth O’Brien:

Everyone in our system, you go in, the property names and addresses are already in there because they came in with the originations. So you don’t type anything. You click the order valuations button. It’s already been QC-ed, we have a QC thing that checks all the street addresses, makes sure they’re clean. It goes out to the vendor who then pushes it back into the system. So when that person comes in two weeks from now and nine out of 12 appraisals are back, they’re already in the right folder. They came in through the FTP site or whatever site it’s using-

Kevin Kim:

Right. So not only are you making ordering process better, but it’s landing in the right place.

Beth O’Brien:

It lands in the right place, so there’s no drag and drop.

Kevin Kim:

That’s huge.

Beth O’Brien:

I mean, that sounds really basic, but like-

Kevin Kim:

No, it’s not. Having to hunt through your Outlook or whatever your email client is, that’s so inefficient.

Beth O’Brien:

It’s never in her email, it’s in the system. And by the way, it’s digitized when it comes in so that if there are fields in there I want to use they’re usable. Nobody’s retyping them.

Kevin Kim:

So I want to kind of shift gears a little bit in talking about the company’s culture, because the company has changed so many times over the years, you guys have rebranded from-

Beth O’Brien:

Our capital sources changed. Our capital sources changed.

Kevin Kim:

Your capital sources have changed. I mean, you guys have added people over the years. And growing to 130…

Beth O’Brien:

Yes, we’re always-

Kevin Kim:

And it’s such a challenge-

Beth O’Brien:

If you look at the people who are running the departments and you look at the senior management team, first of all, the senior management team has been… Ryan and I have been there from the beginning.

Kevin Kim:

Nice. That’s very rare.

Beth O’Brien:

Have not turned over.

Kevin Kim:

Most companies of your size, the principles either typically are retired by now or…

Beth O’Brien:

[crosstalk 00:52:04] been there six and a half years. I mean, when we split from Colony American Homes is when he came in and he’s been here since then. People keep asking me, why do you have such low turnover? I don’t know. I’m not at the other places, but we have very low turnover.

Kevin Kim:

I know this. So we don’t see a lot of folks from your… During COVID we saw a lot of people moving around and stuff like that, either at the entry level or the senior level. But the question to you is now that level of stickiness, what are you guys doing from an employee standpoint? I mean, a lot of our interviews talk about company culture. And a lot of them revolve around values or employee appreciation or training. What about you guys? What do you guys think is your thing that keeps that stickiness?

Beth O’Brien:

I think there’s always room for improvement. And I think like our regular system, we’re trying to always constantly innovate and improve upon it. I think… [crosstalk 00:53:01]. Yeah. We keep adding things. And I do think, I mean, one of the nice things about being part of a public company now is I feel like we’ve been able to roll out more benefits. We’ve been able to do some of the stuff that’s been really important to me. To have a profit participation plan, it was critical to me that it go to every single employee on some level. Which is definitely something I took from Goldman. There was a strong bias; I mean, when I was there for the IPO, every person in the firm got shares.

Kevin Kim:

Nice.

Beth O’Brien:

Not the same number, because they’re not the same exec.

Kevin Kim:

Sure.

Beth O’Brien:

And I was actually living in Hong Kong at the time. And there was a big article on the South China Morning Post the person who was the boat captain on the junk and the tea lady in the office getting shares. [crosstalk 00:53:53]. And so for me, when we rolled out a profit participation plan, it was critical to me that every single employee participated, and not just the senior levels, which was what came to us as, “Here’s the opportunity for a profit participation plan. Would you like it for your senior management team?” And I said, “Well, I’ll take it, but only if it goes to all employees.”

Kevin Kim:

So balance-

Beth O’Brien:

It doesn’t go to everyone on the same percentage.

Kevin Kim:

Sure. But there’s still financial incentive. Even for entry level employees.

Beth O’Brien:

I don’t care what department they’re in. I want them to know that if we had a good quarter, they should have had something for that quarter. Because who cares? Who cares if your employer has a good quarter if you get nothing?

Kevin Kim:

Exactly, what are they working for? And that’s…

Beth O’Brien:

I mean, everybody’s working for a salary and a bonus, but this is independent. This is not related to employee performance. It’s related to firm performance. And I think you have to have a healthy component of both to really incentivize your employees. And look, I’m as concerned as the next CEO over the next year, two years in the workforce in general in the US, I think it’s complicated. We certainly, I mean, we have a high percentage of employees who were hired when we weren’t meeting people in person. And I want them to feel the same connectivity. It’s different. And I think all of us as leaders have to spend more time thinking through how do we continue to develop the type of behavior, the type of cohesiveness that we had when we were all five days a week in the office.

Kevin Kim:

Yeah. And talking about that real quick, so a little bit deeper on that. When you talk about a larger company tied to a public trade company and having all these financial incentives and combine that with remote work, part of it also has to have the level of engagement that you’re trying to create. We struggled with this here during COVID. The level of engagement you’re trying to create with your remote employees, or even just across the country, with OC and LA to New York. The level of engagement is very hard to manage and hard to get. And with today’s generation being of a, I guess they’re more comfortable with Zoom, where I’m pretty bad with Zoom and I hate it. I would rather be shaking hands in person. How do you guys manage that challenge?

Beth O’Brien:

Nothing better than in person. Look, there’s nothing better than in person. And I think that there’s a lot of great protocols now where you can do a lot more in person, and we’re certainly starting to travel again and serve clients that way. But one of the things we did actually, we did a bunch of different things, I’m sure you did too. I’m like, there’s only so many trivia nights you can do as a company, it’s going to get kind of plain.

Kevin Kim:

Zoom happy hours. Like, come on.

Beth O’Brien:

Like yeah, thank you, I can drink by myself with no video.

Kevin Kim:

Yeah, exactly.

Beth O’Brien:

I went to college. I have two kids in college. The first thing they did when we were locked down, when we had the grocery list, was put White Claw on it. I’m like, “What’s a White Claw?” And my daughter’s like, “Mom…”

Kevin Kim:

I discovered White Claw during COVID, and I drink it a lot now.

Beth O’Brien:

And my daughter’s like, “Mom, it’s like La Croix but different. Just buy it.”

Kevin Kim:

Pretty good.

Beth O’Brien:

You know what, she’s right. She’s like, “Just buy it, Mom.” But yeah, if you’re going to lock down with some young adult children, you have to buy White Claw. But anyway, one of the things we wound up doing that was this total super hit. I mean, it was really a hit, and we did it as a client thing but it wound up being this great employee engagement thing. We put together a cookbook of what people did in quarantine. We solicited from the… And we put together the CoreVest quarantine cookbook and lots… I mean, I couldn’t even believe how high a participation it was from the employees.

Beth O’Brien:

But the thing that was so wonderful about it, Kevin, was that the employee voice came through. So people put these little stories in the email like, “There’s a place near the office where I always got the following chicken Katsuya for lunch. And I tried for weeks at home to make it just right until I got it so that I could have the lunch I was having.” Or somebody else put together a little business with some of their friends, or there was a block party potluck. And all of these interesting quarantine stories came out through the submission.

Kevin Kim:

That’s nice.

Beth O’Brien:

That we put into the book, we mixed it all together. And then our marketing department, I mean kudos to them, came up with like the most hilarious names for the recipes. We had a drink section and a food section, and like, Bring Back Mai Tai was the Mai Tai. Everyone had kind of a COVID pun, but was related to the rest. And they were all fantastic.

Kevin Kim:

That’s nice. I like that. Because you’re not only getting the stories through food, and that’s one of the best ways you can convey stories through food. But also you’re getting that level of that extra lower layer of what they’re really dealing with as a private person.

Beth O’Brien:

And what it did for the first time too, is it highlighted people across the organization. We put together a real book and we sent it out to our clients and it highlighted people across the organization. I’ll send you one. They’re so fantastic. But it highlighted people across the organizations that the clients didn’t always deal with, I really think-

Kevin Kim:

That’s so important. Yeah, yeah, yeah.

Beth O’Brien:

Humanizing. And then we had a contest among the employees, who could try the most recipes. So even if you didn’t submit one, if you tried the most recipes, you would still get the prize.

Kevin Kim:

Awesome.

Beth O’Brien:

So we sent out branded merch. And you know what it did, Kevin, that we were missing completely, and that all the other stuff wasn’t doing? It started getting employees in different departments that didn’t know each other, or didn’t normally talk to each other for business, to talk to each other about these crazy recipes. Because they’re like, “I made your pho,” or, “I made your squash [crosstalk 01:00:00].”

Kevin Kim:

Once again, food. Food is that unifying factor. You found something that… And also was a big deal during COVID, everyone started cooking at home and baking.

Beth O’Brien:

Everyone was cooking. And we sent home aprons and little tumblers and stuff to go with it.

Kevin Kim:

Oh, that’s awesome.

Beth O’Brien:

Anyway, that created the most employee-

Kevin Kim:

But the thing is now people are going full… We have a lot of clients who’ve basically gone full remote. We have a full remote workforce, a chunk in the office, and they’re racking their brains for how do you have this engagement?

Beth O’Brien:

How do you do it, yeah.

Kevin Kim:

And this is a really wonderful idea.

Beth O’Brien:

So you know what’s interesting is I heard a fantastic talk that Ruth Porat, the CFO of Alphabet, gave recently. And she said the reason that the great work from home experiment worked was because A, we all did it together. And then B, we had this amazing reservoir of connectivity that we were really relying on. And at some point you do have to replenish the reservoir. And so we’re not 100% remote anymore, we are hybrid, which I think does work. We’re looking to recreate some of that connectivity but also maintain some flexibility. So that’s where I think we’re all going to struggle over the next year or so, working through.

Kevin Kim:

Agreed, agreed.

Beth O’Brien:

But in the back of my mind, this idea of the deep reservoir of connectivity is so important.

Kevin Kim:

And are you guys doing that as a company? How are like your east coast operations and your west coast operations? Because I mean, Irvine to LA, you guys can probably create the venue for the meet person. New York to west coast, that’s going to be a little more challenging. Does CoreVest do anything to bring all your employees together? Anything like that?

Beth O’Brien:

Occasionally we do, mostly for training we’ll have people travel, which had fallen off a bit, obviously, but is coming back.

Kevin Kim:

Yeah. There’s nothing better than going to the east coast with your team. You build that camaraderie while you’re traveling. That’s cool.

Beth O’Brien:

We also do a lot of site visits and conferences and so we try to staff it so that people from different groups are going.

Kevin Kim:

Oh, that’s nice. So then they can prepare together. And then they meet in person. That’s wonderful. Okay.

Beth O’Brien:

But I’m particularly deliberate… I’m deliberate about most things, but particularly deliberate when we have training sessions to make sure it’s different groups, appropriate for the seniority. So sometimes it’s not different seniority, but different offices in different groups, so that you’re not just always with the same people.

Kevin Kim:

Cool. I want to switch gears a little bit. I want to talk about your thoughts on the industry. Because one of the people that I’ve actually wanted to get these thoughts on was definitely you, because you’ve been involved for very long, but also you have a different perspective on it because you’ve built one of the most recognized brands in the space, but also having a different perspective because of your capital markets background and understanding, you’re a balance sheet lender, but you also have a very strong knowledge of what Wall Street wants. And where we are today, I feel like it’s a weird time. I feel we’re in a very weird time in the marketplace because we’re out of COVID, it’s white hot, I mean…

Beth O’Brien:

Hot, hot, hot.

Kevin Kim:

It’s white hot right now.

Beth O’Brien:

I think this is like phase three of the institutional capital coming in at least.

Kevin Kim:

Okay. So let’s talk about that. So tell us how you view that. What are the phases to you? Because I have my own views on this.

Beth O’Brien:

So there was the original phase when people just decided we’re going to come in and buy, because they felt it was a dislocation in pricing in the US real estate market. But that’s back when everybody was saying, “Is it a trade or a business?” And most people thought it was a trade. People thought they were going to come in, buy the distress, flip it, and then it would normalize. So I would say that was phase one, and that-

Kevin Kim:

That’s buying the houses to be clear, they’re buying the houses.

Beth O’Brien:

Right. Buying the houses. And there was a little bit of debt going on in them, but not a lot because people were afraid of the debt. So then the next phase, all of a sudden people were like, “Well, we can’t really find any bonds.” The bond market was kind of dry. And so people started trying to build on their balance sheet mini bonds by using these rental payments. And so the next level of fixed income people started coming into the equity space as well. And it wasn’t about HPA anymore, that’s when it first started to be about yield, because there wasn’t a good, attractive risk adjusted yield elsewhere that they could buy and supplement with that. Now it’s aggressively about yield, but also just there is nowhere else for the capital to go.

Beth O’Brien:

And because of the fundamentals, people are finally understanding, I think… It was literally my thesis like eight, nine years ago is that we have a fundamental housing shortage in the US, and particularly at the workforce housing level, which is where most of this is. I mean, some of the institutional players are one notch above that, like an Invitation Homes is probably twice the value house of what I’m financing, but still it’s within range. It’s still below the entry level home builder house. And so you’re looking at now people just plain want to play the demographics, which is you have household formation off the charts. You have rents going up. You have HPA. You have everything happening at almost the same time. And it’s not that COVID caused debt, it’s just that it accelerated the trends that were already in the market. It surprised me that this third wave didn’t actually happen a little bit sooner.

Kevin Kim:

Yeah. It was actually an interesting thing to me as well. I was wondering, because you look at corollaries in other mortgage spaces, I look at the commercial space, the conventional space. And I was looking at our space where we live, tail end of ’19 going into ’20. And I was like, “Why are these guys still buying up loans? It’s all they’re doing. They’re just buying loans. Why are they doing that?” And then COVID happened. And then we got out of COVID late summer. And then all of a sudden we started seeing larger yield spread, which wasn’t a thing in ’14. Yield spread wasn’t a thing. Credit line started coming out. Mass repurchase agreements starting to come out. The aggressiveness on both the fix and flip and the rental. And to your point, is that it’s tied to the core fundamentals in the housing market.

Beth O’Brien:

Yeah. I actually believe it’s real demographic change.

Kevin Kim:

I agree with you.

Beth O’Brien:

And demographic numbers that are driving it. Now, I think there’s some ancillary stuff in the market, like the evaporation of the hospitality and office space at the same time. So there’s all this extra capital on the commercial side that kind of moved towards that.

Kevin Kim:

They need a place to put it.

Beth O’Brien:

They needed a place for that.

Kevin Kim:

There’s not enough industrial to feed all that either.

Beth O’Brien:

You can only do so much industrial.

Kevin Kim:

That causes allocation imbalance. But the question with that is-

Beth O’Brien:

There was going to be some of those market things happening, I’m not saying it’s 100%, but I think at it’s core’s a demographic move that was starting to happen pre COVID, but this accelerated it.

Kevin Kim:

When do you think a lot of like the Wall Street and the financial institutions accepted this asset class as a true asset class? I didn’t really think they accepted it-

Beth O’Brien:

Pretty recent.

Kevin Kim:

Right?

Beth O’Brien:

I think it’s really pretty recent, Kevin. It’s crazy. I mean, it doesn’t feel that long ago to me that I was calling the Street begging for a line, and now if anybody could give me a line, they would.

Kevin Kim:

It feels like even retail banks and regional banks now understand it. I’m starting to see more like these regular retail, regional banks jumping in on the lender finance side. They’re understanding the product.

Beth O’Brien:

Yeah. We definitely feel competition from the regional banks. We always have. It tends to be more relationship driven and very local. And we tell people that can get it, they should get it. That’s really advancing. Tends to be lower leverage and a little slow. It depends, it depends on what your goals are. If your goal is-

Kevin Kim:

Right. But it’s still the fact that they’re understanding it. Let’s throw the fact that they’re lending on this stuff aside real quick. You’re providing credit line. More small banks are now jumping into lender finance for the balance sheet lenders out there. And we’re starting to see, and we just saw another bank purchase, we have a civic transaction, but then we also see the large institutional banks invest heavily, heavily in this sector and-

Beth O’Brien:

I think what you’re going to see, I mean, I think it’s no secret that there’s a bunch of M&A activity happening over the next several months.

Kevin Kim:

Consolidation and…

Beth O’Brien:

There will be either some consolidation or the other thing I think that’s happening is there’s such a demand for the assets, at the insurance company balance sheets, and [crosstalk 01:09:07] institutional, particularly the insurance companies, who really need assets against-

Kevin Kim:

And that goes to your point earlier, with the commercial stuff, they used to love of the commercial stuff and they can’t get their hands on it right now or they won’t touch it.

Beth O’Brien:

Right. So I think what you’re going to see, one of the things that’s going to be interesting to watch is if enough of the… Everybody knows that there’s transactions happening. Nobody really knows where the homes are going to be yet on some of them. It’ll be very interesting to see if insurance companies, and I think in a few cases it will be, at least behind the institutional capital there’ll be an insurance company; if they wind up with these assets, you’re actually going to see, like right now there’s a really healthy flow of assets into the bridge loan securitization market. Some of these M&A activities may take those assets off the market. It’s not that you’re not going to be creating the asset. The assets won’t disappear, but you won’t see them come back in the securitizations. You’ll see them go directly to the insurance company balance sheets. And I think that’s also going to have some interesting capital markets implications.

Kevin Kim:

Yes. I mean, if you start changing the game from securitization to balance sheet, when additional product that comes from that, unless you’re the actual securitizing company, the way you underwrite shifts dramatically, and the way you evaluate assets and take down assets and deal with defaults is going to change dramatically. And that’s going to change, I mean, hopefully it won’t cause a race to the bottom, which we saw early, but…

Beth O’Brien:

I hope not. I mean, look, the insurance companies don’t want bad assets either. Maybe it improves it. You never really know what the total impact is, but there’s going to be a change coming.

Kevin Kim:

Like you said, right? It’s every quarter in this space.

Beth O’Brien:

This is going to be the revolution next quarter, is where are these assets showing up, and is that going to impact the front end or not? And you could go either way, but I think that’s one of the things that’s certainly on my mind, where’s the…

Kevin Kim:

I want to bring up another one then, because DSCR is another thing where I have conversations with people about this from all walks of life, and even my Uber driver today. But talk about-

Beth O’Brien:

What did the Uber driver think? I always want to know that.

Kevin Kim:

He didn’t understand why anyone would rent their house. I was like, “Well, hold on.” But I think he didn’t understand the idea of it as an investment. But from a, I guess market standpoint, one of the things that’s been brought up commonly; and I want to get your thoughts on this because UIs are so heavily entrenched in the DSCR sector and you guys are kind of the industry leader, in my opinion; is the threat of what I would call conventional mortgage banks in the DSCR product asset class. If we were to create that as its own asset class, the threat of the conventional mortgage banks coming in or competing or creating a challenge, it’s been brought up.

Beth O’Brien:

So they certainly could. Normally, when I think about a threat like that, I try to believe all entrants are good entrants because it will definitely drive down coupon, but it may commoditize it, it may make it more profitable to do. You got to figure out a way that if that happens, that you take advantage of it too. There’s something about improved liquidity that’s causing that hopefully, and it’s not just a degradation of credit standards. So you try to participate if you can. But I actually don’t think the risk is that great on the true resi originator. And the only reason why I think that is because I was pounding on their doors for like a year and a half, trying to get them to do this product for me and do it on a correspondent basis, and had a really hard time getting… The mindset wasn’t there for it.

Beth O’Brien: