Many of you are familiar with the UCC forms used to make financing statement filings with various state government offices and upon the land records as fixture filings. The forms we are used to were last updated in 2011. Now, the International Association of Commercial Administrators (IACA), the international organization responsible for maintaining common forms, has released the updated UCC forms and their instructions for 2023.

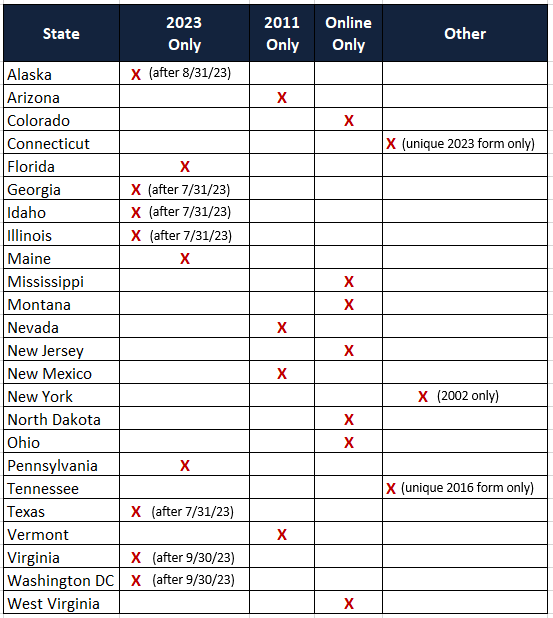

While most states will allow the use of both the old 2011 and the new 2023 forms, be aware that the following states may only accept certain versions of the form or must be filed electronically:

If you are using Geraci or Lightning Docs standard loan documents: no action is required on your part as our team has already begun the update process to include the new versions of these forms to be active in the relevant states.

If you are not using Geraci or Lightning Docs standard loan documents: please feel free to call our attorneys to answer any questions you may have and we can provide the state specific UCC forms you may need.

Changes to the Forms and Instructions

Very little of substance has been changed in the various forms, and not much more in the corresponding instructions. Below is a brief list of the changes having been made apart from any typographical or formatting changes:

- UCC1 (Financing Statement): Changed “Filer” to “Submitter” in some locations on the form. The instructions now include a warning against using handwriting on forms, a warning against including personally identifiable information of the debtor (PII), an allowance for use of name variations, and a simplified instruction for assignees of the creditor.

- UCC1AD (Financing Statement Addendum): No Change.

- UCC1AP (Financing Statement Additional Party): No Change.

- UCC3 (Financing Statement Amendment): Changed “Filer” to “Submitter” in some locations on the form. The instructions contain much of the same changes to the instructions on the UCC1 with the addition of revised instructions for filing of Continuations, which must be done 6 months before the lapse date, and additional clarity on partial assignments.

- UCC3AD (Financing Statement Amendment Addendum): The form includes an additional checkbox and the instructions now contain similar warnings against handwriting on the form and the inclusion of PII.

- UCC3AP (Financing Statement Amendment Additional Party): No Change.

- UCC5 (Information Statement): No Change.

- UCC11 (Information Request): The form includes new or modified checkboxes, including the use of an “all available liens” option. The instructions contain many of the same warnings as in the UCC1, but also include restrictions on using debtor trade-names (DBAs etc.), guidance on the use of the “all available liens” checkbox, and a strong suggestion for the use of online services in lieu of using this form.

Please call our attorneys or reach out with any questions, concerns, or comments on the Uniform Commercial Code changes.