Raising capital is a necessary component for businesses in any industry, and the real estate and finance industry is no exception. After a general strategy is planned out, selecting the right securities exemption framework is crucial for the strategy to succeed.

Creating a fully registered fund at the start is not an ideal option because of the cost, red tape, and regulatory burden on the sponsor. Commonly utilized securities exemptions are the preferred choice for many of our Geraci clients.

In this article, we’ll cover the most selected choices for federal securities exemptions in real estate and private lending. State securities exemptions will not be covered in this breakdown, as sponsors rarely raise money in a single state.

Key Requirements Needed for Federal Securities Exemptions

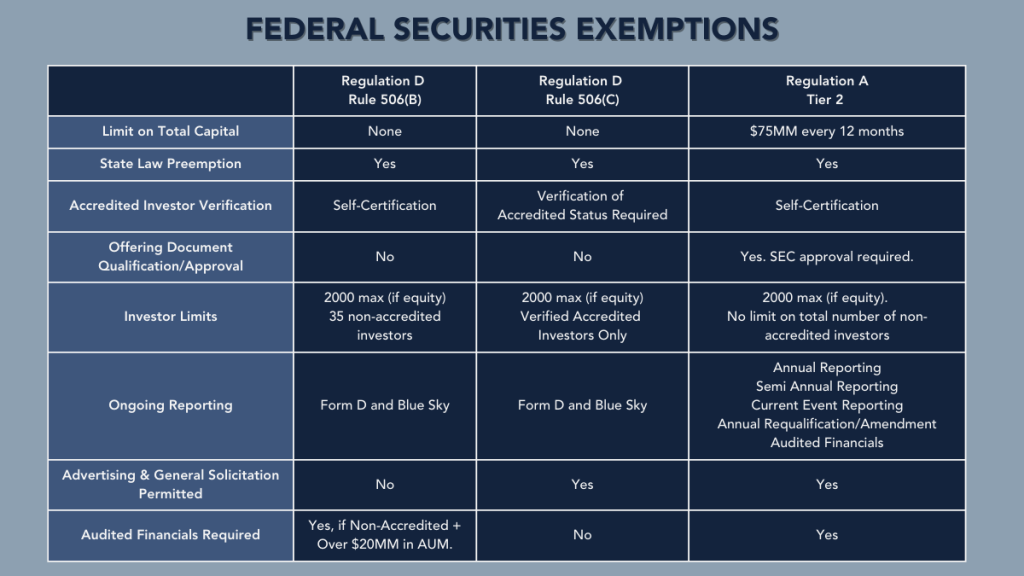

This chart lays out the basic requirements for each exemption, excluding exemptions like Rule 504 or Regulation A Tier 1 because they are not commonly utilized. The primary reason for this is that they are unreliable, as they do not preempt state law. Further, we did not include Regulation CF because its $5,000,000 every 12-month limit is not considered useful for most real estate and private lender sponsors.

Below are the key requirements of the three most relied-upon Federal Securities Exemptions.

Selecting the Right Exemption for Your Business

Now that we’ve laid these out, let’s discuss the options.

Regulation D 506(B): Primarily useful for sponsors that want to do what is commonly called a “friends and family” raise. This is likely to include a handful of non-accredited investors as a prerequisite. In this scenario, Regulation D 506(B) is the most useful option. Regulation A Tier 2 is not a strong fit in this scenario, because of the enhanced cost and time spent operating a Regulation A Tier 2 offering. In addition to this, sponsors that do not wish to publicly market their offering and/or do not wish for their accredited investors to go through the verification process often choose Regulation D 506(B) as well.

Regulation D 506 (C): Today, most sponsors choose 506 (C). Over 70% of offerings prepared at Geraci use this exemption. The reasoning is that (a) real estate and private lending sponsors typically require larger investments, making accredited investor requirements manageable; (b) they want to publicly promote offerings to stay competitive in the digital age; and (c) verification is now simpler and less burdensome.

Several vendors provide verification services, and the safe harbor practice is less burdensome, as the four professionals (CPA, attorney, broker-dealer, investment adviser) are comfortable offering it.

Regulation A Tier 2: Ideal for experienced sponsors seeking a public offering, including non-accredited investors, and the ability to market widely. It’s not recommended for emerging sponsors due to its higher costs and reporting requirements, including SEC qualification and audited financials. SEC approval takes six to eight months, making it better suited for sponsors with more capital and resources. This is why it’s commonly used by crowdfunding and fintech companies.

Understanding Your Capital Raising Options

If you are exploring the possibility of structuring a fund, raising working capital, or navigating federal exemptions, our team at Geraci LLP is here to help. Our experienced professionals can guide you through the complexities of Regulation D, Regulation A, and other capital-raising exemptions, ensuring compliance while optimizing your fundraising strategy. Contact us today to discuss your specific goals and determine the best path forward for your business.