As a second term unfolds for the Trump administration, many significant policy changes are already underway via the executive branch. While these changes are largely favorable for the Republican party, their slight majority in both the Senate and House of Representatives could prove problematic for enacting bills relating to tax reform. One tax bill that faces an uncertain future this year is the Tax Cuts and Jobs Act (TCJA).

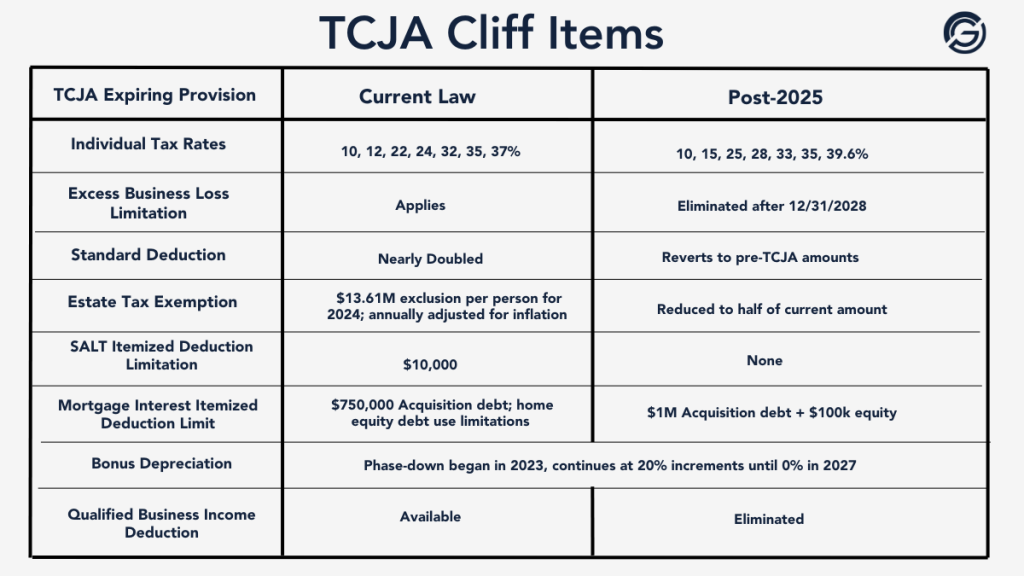

While many aspects of the TCJA are expected to remain, there are several temporary items due to expire in 2025 which will either remove them entirely, like the Qualified Business Income Deduction, or reduce them significantly, like the Estate Tax Exemption.

These impending changes have spurred a push for an extenders bill, titled TCJA 2.0, that could be a catalyst for more tax reform. However, the bill requires compromise from both parties and despite the call for swift action, delays may be imminent.

How Will This Impact My Business?

The TCJA created many important tax cuts. Two of the most impactful to private lenders were (1) reducing the corporate tax rate, and (2) creating the Section 199A qualified business income deduction. These two cuts created increased incentives to invest in private lending, particularly in Mortgage REITs.

Further, the vast majority of private lending operating companies are structured as pass-through businesses, so the Section 199A deduction became much more impactful.

Navigating the Future of Tax Reform

The future of tax reform in 2025 relies heavily on the budget reconciliation process. This process allows for partisan tax legislation to pass with just 50 votes plus the Vice President in the Senate, bypassing the need for Democratic cooperation. Anticipating this, Republicans in Congress are preparing for swift action.

The proposed tax reconciliation bill advocates for several new measures in addition to extending the TCJA or making it permanent. This includes (1) no tax on tips; (2) no tax on overtime; (3) reducing the corporate tax rate for US-made products and services; (4) no tax on social security and (5) increasing the SALT deduction cap.

The reconciliation process will be key to passing tax legislation on a partisan basis. The biggest challenge will be determining whether to pursue a single, all-encompassing reconciliation bill or two smaller bills, addressing more complex tax provisions later.

The decision to use a single bill could help secure broader support, as it would allow Republicans to bundle tax reforms with other priorities like immigration/border security, an enhanced military budget, and energy policies. As of January 27, President Donald Trump has advocated for one bill, but additionally stated he would not rule out two.

The Prospects for TCJA 2.0

Although Congress and President Trump want immediate action on a tax bill, the intricate and complex list of inclusions may lead to significant delays. As of now, the government is only funded through March 14, and the debt ceiling suspension that expired on January 1 still needs to be addressed.

Despite these hurdles, TCJA 2.0 could be the vehicle for a major overhaul of the tax system. Included in the package are provisions to extend the current tax cuts, and address Trump’s campaign promises.

An important area that could be influenced by TCJA 2.0, is clean and renewable energy. The push for tax incentives aimed at supporting clean energy initiatives is expected to be a significant part of the upcoming legislative discussions.

The timeline for the reconciliation process is tight, with significant milestones looming. The first step will be the passage of a budget resolution by February’s end, which would set the stage for the budget reconciliation package. This will allow tax provisions to move forward to pass them by May 23, 2025.

Debates over using a “current law” or “current policy” baseline will shape the reconciliation process. A current policy baseline would extend the TCJA without additional cost projections, while a current law baseline could lead to significant tax policy changes, affecting everything from estate taxes to business deductions.

As of February, the House has submitted a budget resolution with various items and there is still consternation whether this will be a single “big beautiful bill” per President Trump or two separate bills.

Staying Informed and Prepared

As the legislative process unfolds, businesses need to stay informed and prepared for the potential impact of TCJA 2.0 and the broader tax reform efforts underway in 2025. The potential for changes in tax incentives—especially in areas like community development, affordable housing, historic preservation, and clean energy—requires vigilance and proactive planning.

Contact your Congressperson and Senator and express your support to extend the TCJA and the positive impact it has had on small businesses including yours.

By staying updated on the latest industry news and legislative developments, businesses can better navigate these changes and ensure they are in the best possible position to take advantage of tax reforms or mitigate the risks posed by potential policy shifts. Click here to subscribe to our newsletter today and stay informed.