Contributed Articles

- Contributed Article

- November 2024 (AAPL)

- In an environment where fraud is a constant threat, private lenders both large and small need robust and reliable solutions to protect themselves and their clients. By choosing Sekady, lenders are not just protecting their financial interests—they are also safeguarding their reputation and building trust with their clients.

- Contributed Article

- November 2024 (AAPL)

- We are always available to you and excited to help strategize your plan. Doing so is the only responsible way to manage your asset. If you don’t know where you are trying to go, any road will take you there.

- Contributed Article

- November 2024 (AAPL)

- Trust me on this one: lending isn’t just about dollars and cents. It’s about trust. Building relationships with colleagues, partners, and potential clients helps establish that all-important foundation of reliability and respect.

- Contributed Article

- November 2024 (AAPL)

- "No matter the size of your company, having someone dedicated to the marketing manager role is essential. It’s crucial to the survival, growth, and long-term success of every private lending company."

- Contributed Article

- November 2024 (AAPL)

- Like shrinkage in retail, perhaps it’s time to view—and quantify—fraud as a cost of doing business. When it becomes another operational line item, it’s easier to discuss frankly, practically, and without a cloud of shame for being ʻtaken.ʼ

- Contributed Article

- November 2024 (AAPL)

- "In a sea of commoditized lending, family offices stand out for their personalized, flexible approach, offering specialized solutions where traditional lenders fall short."

- Contributed Article

- November 2024 (AAPL)

- "We are no longer just surviving; we are thriving and positioning ourselves for big growth."

- Contributed Article

- November 2024 (AAPL)

- The main challenge in many states is ensuring that the private lending company is properly licensed. Although states have different rules regarding usury, prepayment penalties, and other loan conditions, these can typically be addressed by adjusting the loan agreement.

- Contributed Article

- June 2024 (Women in Private Lending)

- Purpose is tied to your values, motivations, passions, and self-examination. It’s in there – you just have to do the work to find it.

- Contributed Article

- June 2024 (Women in Private Lending)

- Most professionals don't grow just from doing the job itself. It comes from being figuratively ‘knocked down.

- Contributed Article

- April 2024 (Innovate)

- Lenders should also seek builders who consistently leverage lien waivers and manage financial aspects with transparency. This trust cultivates long-term relationships, easing the path to support future projects.

- Contributed Article

- April 2024 (Innovate)

- The journey doesn't stop at closing. Brokers celebrate their clients' successes, sharing in their achievements and offering ongoing support as their portfolio grows.

- Contributed Article

- November 2023 (AAPL)

- The experience of coaching taught me invaluable lessons on being proactive and protective. These lessons, which apply today and have produced incredible results over my 40 years in lending, collectively amount to the dos and don’ts of organizational leadership.

- Contributed Article

- November 2023 (AAPL)

- Much like a loan moving through our process, we must always make sure that quality of our loans is airworthy. Currently, we are seeing 57% of our files close in 13 days or less. On top of that, for some of our more experienced, high-volume clients, we have been able to get their loans into closing in five days or less!

- Contributed Article

- November 2023 (AAPL)

- When a fraudster hijacks your business’s identity–your website, your name, your reputation–it won’t be because an employee unwittingly clicked a malicious link or didn’t properly verify loan documentation. There is no training or awareness campaign that can prevent it because it’s not predicated on any exposure or attack point. It’s entirely external.

- Contributed Article

- August 2023 (Captivate)

- Real estate opportunities will always abound. It is the shrewd real estate investor who knows how to navigate through turbulent times. These investors are continually looking for capital. Investors and developers of much-needed SFR and multifamily housing continue to require capital, and it is the alternative lending industry that has come to the forefront to reliably serve that demand.

- Contributed Article

- June 2023 (Women in Real Estate)

- "My first piece of advice is making sure you have the right team in place. Make sure everyone you hire respects the position and aligns with your core values and vision. Surround yourself with good people. This is really important. Find people who bring positive energy — people you want to be around. You will be highly affected if you have 'energy drainers' around you. You strive and thrive in highly vibrational atmospheres."

- Contributed Article

- April 2023 (Innovate)

- Social media has become an essential part of a business’s marketing strategy and allows companies to connect with their customers, share their products or services, and increase brand awareness. Some people are genuinely surprised to learn that growing a brand’s social media presence is more than posting a few updates and scrolling. To be successful, it takes time, effort, and strategy to build a strong presence that drives results.

- Contributed Article

- April 2023 (Innovate)

- Law firms are notoriously slow to adapt to change, eschewing it for the notion that “if it isn’t broken, why fix it”. However, embracing change and making innovation a priority is one of the key driving forces behind our success at Geraci LLP. We recognize that, in the highly competitive legal industry, firms that fail to innovate and adapt to changing market conditions risk becoming obsolete.

- Contributed Article

- February 2023

- Gary decided that holding private notes and mortgages would be a fitting strategy for his Roth IRA. His funds enable borrowers to invest in additional real estate projects, providing a benefit to the community as well as his retirement account through interest earned.

- Contributed Article

- February 2023

- I have seen so many lender websites with one basic page for capital raising. While it’s relatively easy to add one “invest” page to your existing website, I recommend building a separate website to focus on the investment offering. Keep your primary site focused on loan origination.

- Contributed Article

- February 2023

- In this industry, as in others, there will always be an element of reliance upon others and their representations. If a document or a story sounds fishy or too good to be true, it very well may be. Always ask questions. The more a fraudster is required to lie, the more likely they will make a mistake, and the truth will come out. We can only do our best to resist fraud. It is up to you to put up the fight.

- Contributed Article

- February 2023

- The REO is sold, and a balance remains. You find yourself a “sold out junior”, or the REO didn’t gather the full balance owed on your loan, so the collateral is exhausted, but amounts remain unpaid. This is your “deficiency balance”. You’ve negotiated with the borrower for a payment plan or a lump sum. You’ve sent a “demand letter”, and the money has not come through. Now what?

- Contributed Article

- December 2022

- I anticipated that more funds would start in 2022, and I was right! Our Corporate & Securities department has seen double the number of funds than the previous quarter. Funds are coming back due to lenders’ uncertainty about when Wall Street is buying.

- Contributed Article

- December 2022

- While the fiercely opposing forces of low housing supply and affordability make a housing crash unlikely, private lenders are left wondering what needs to crack for their origination machines to crank back up again. If prices remain elevated but relatively stable, and the market shifts from the bidding wars of yore to a “buyer’s market", that is a decent environment for buy-rehab-sell investors.

- Contributed Article

- October 2022 (AAPL)

- "At any given time, I am working with numerous outside technical vendors including web developers, internal and external document coders, and workflow consultants to try to create a better loan document solution. We built a best in class nationwide online loan document solution that produces thousands of loan documents per month, and we’re not stopping anytime soon."

- Contributed Article

- October 2022 (AAPL)

- During The Great Recession, the US saw a huge wave of mortgage defaults. Fast forward 15 years, and real estate prices have increased substantially to overcome the devastation of the previous drop. Banks are now only allowed to make loans to borrowers who can demonstrate an ability to repay, and all of this makes for a strong real estate market.

- Contributed Article

- August 2022 (Captivate)

- "No single leader is meant to have all the answers. By empowering the team around you and showing appreciation for each team member’s voice, associates will want to speak up and contribute. Nothing is more powerful than when all team members row in the same direction, for the betterment of the company," says Tricia Mitchell, Chief Operating Officer at Archwest Capital.

- Contributed Article

- August 2022 (Captivate)

- "The frenzy that ensued for house purchases was a boon for private lending. Not only were banks a bit gun shy due to the pandemic, but buyers were facing competition and needed a competitive edge – quick closing offers. Because banks slowed down on lending and the ability to provide capital very quickly, many private lenders had their best deal flow, by volume, in decades," says Edward Brown of Pacific Private Money.

- Contributed Article

- August 2022 (Captivate)

- With so much uncertainty and change anticipated in the housing market, the question is more important now than ever – which is a better strategy: Diversification or Specialization?

- Contributed Article

- June 2022 (Women in Real Estate)

- Thanks to the guidance and support from her male colleagues, Tricia Mitchell, Chief Operating Officer at Archwest Capital, was able to start her career when she was just an intern at a start up company, and now she wants to give back and help other women trying to make their way into the private lending space.

- Contributed Article

- June 2022 (Women in Real Estate)

- The Fay Group is made up of a family of companies that are structured to provide full lifecycle products, services and strategies in the mortgage and real estate sectors. Originate Report recently sat down with eight executive women from the Fay family of businesses to discuss and reflect on their careers.

- Contributed Article

- June 2022 (Women in Real Estate)

- Owning the room has significant positive connotations of drawing people in and being relatable and insightful. What makes one person stand out from the crowd in a positive light? What brings our focus to that person, leaving us wanting more as soon as it is over?

- Contributed Article

- April 2022 (Innovate)

- The proposed Good Cause Bill, currently making its way through the New York legislature, would limit a landlord’s ability to evict non-paying tenants.

- Contributed Article

- April 2022 (Innovate)

- Since your marketing is the sales presentation of your business to the world, then true marketing requires a tangible paradigm shift in order to truly stand out from the rest of the typical all-too-prevalent marketing.

- Contributed Article

- February 2022

- The fundamental reason the DSCR program is so powerful is that the long-term hold is now a popular strategy for many real estate investors who have historically been flippers.

- Contributed Article

- February 2022

- Regardless of whether you are closing your first deal or your hundredth, these loan types are all potential financing options at your disposal that can be successfully used to add the perfect rental property-secured loan to your portfolio.

- Contributed Article

- December 2021

- Over the last year, Roc Capital maintained a commitment to its clients and continued to lend and provide liquidity, while most stopped, bolstering originations substantially. Roc focused on increasing the availability of new products, at desirable terms, to lenders, originators, investors, developers, landlords, and the like.

- Contributed Article

- December 2021

- At its most basic, wire fraud can be summarized as fake invoice fraud delivered with social engineering tactics. The attacks range in sophistication from very basic phishing and spoofing attacks to much more advanced cases including business email compromise, ported cell phones, and deep fake authorizations.

- Contributed Article

- December 2021

- "We had anticipated that 2021 was going to be the best year ever for CFSI, ultimately it was, but it was challenging for our clients and team with the lingering effects of Covid on the psyche, client lending practices, housing inventories, and the new political environment," says Founder and CEO Brian Mingham.

- Contributed Article

- December 2021

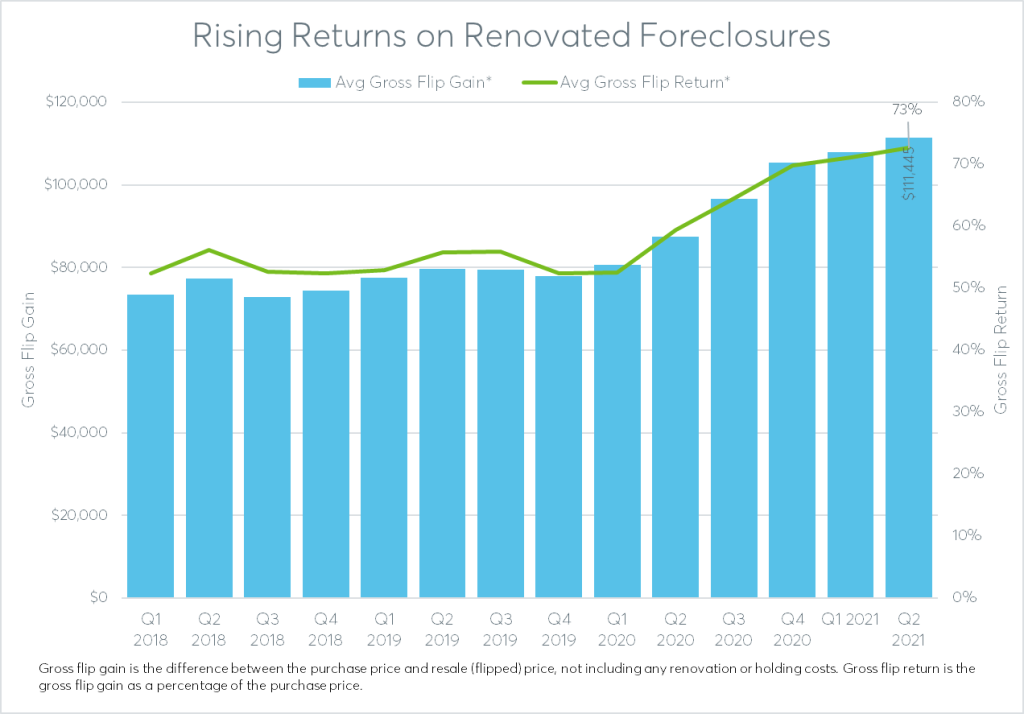

- "The good news for real estate investors struggling to find value-add inventory: the foreclosure auction tide is slowly starting to rise," says Auction.com's Daren Blomquist.

- Contributed Article

- October 2021

- I think that one virtue I hold dear, and that I see in the team we have in place at Arixa, is that we never sway from championing our clients and seeing projects through to completion in the best way possible," says Managing Director Greg Hebner.

- Contributed Article

- October 2021

- Learn the differences between private lending and conventional lending, as well as the misconceptions about private money lenders.

- Contributed Article

- August 2021

- Sustainable passive income combined with a growth-minded perspective is a winning combination regardless of asset class and that’s exactly what investors will find when they choose Voyager Pacific Capital—a vertically integrated investment firm that utilizes efficient capital deployment into fragmented secondary and tertiary markets to deliver premium risk-adjusted returns via their dynamic duo of vehicles: Voyager Pacific Opportunity Fund II and Voyager Pacific High Yield Fund III.

- Contributed Article

- August 2021

- "We believe that business – like life – is about being in the right place at the right time. If you do your part, you can make your own good fortune. With our technology portfolio, we position ourselves to be in the right place at the right time for our partners, and we’re able to align our interests to create a better-shared future," says David Novosellar, Co-Founder and President of Novello Financial Group.

- Contributed Article

- August 2021

- We are just as much in the business of establishing and maintaining relationships as we are lending money,” says Rehab Financial Group President Susan Naftulin.

- Contributed Article

- August 2021

- “When PeerStreet is approached with an opportunity to acquire or fund a loan, we always want to make sure we understand the borrower’s business plan, that they have the experience and financial wherewithal to execute the business plan, that the market can support such a project, and that the leverage and cost of the loan accurately reflect the risk of the transaction so that it is sellable in the market," says PeerStreet Co-Founder and CCO Brett Crosby.

- Contributed Article

- October 2021

- "Our knowledge, and willingness to share it, can help to improve the end results, and at the end of the day, that means borrowers avoid headaches and make more money. Don’t settle for a lender that is absent, difficult to contact, and lacks concern for your success," says David Nielson, Partner at Boomerang Capital Partners.

- Contributed Article

- August 2021

- Fund raising is competitive with many types of deal structures to entice potential investors. The most common trend today involves mortgage or debt funds offering a preferred return rather than one solely based on allocable net profit. This article discusses the basics of a preferred return.

- Contributed Article

- August 2021

- If you're a mortgage investor who invests in individual notes or trust deeds, there are still many opportunities for you, but you must put in some work to get more deals from loan originators. Rocky Butani discusses 6 tips for mortgage investors to get more deals from originators.

- Contributed Article

- August 2021

- The secret to The Bedrock Fund's success? They only offers financing to a carefully vetted contingent of qualified investors with proven track records of producing optimal returns on well-researched investment projects.

- Contributed Article

- June 2021 (Women in Real Estate)

- "The great thing about lending in general, but especially private lending, is that you don’t have to go it alone. You can help yourself by building a team," says Alex Breshears, Chief Action Officer at Golden Raptor Capital.

- Contributed Article

- June 2021 (Women in Real Estate)

- Susan Naftulin, Co-Founder of Rehab Financial Group, discusses scenarios that are all too familiar for women in any male-dominated industry and shares the advice she would give these women.

- Contributed Article

- June 2021 (Women in Real Estate)

- "While my start in the Private Lending industry was due to a bit of luck and good timing, my climb up the ladder from an entry-level Marketing Associate to CMO was no fluke. Even though I had limited knowledge of the space when I started, I took it upon myself to immerse myself in the industry and learn as much as I could so that I would ultimately succeed in my role at RCN," says the Director of Marketing Erica LaCentra.

- Contributed Article

- April 2021 (Innovate)

- What makes a soft money loan groundbreaking in the mortgage world, is that a borrower can also build or repair their credit with a soft money loan, making it appealing to those with lower credit scores or those looking to rebuild their credit. The combination of lower rates, credit building, and a longer time frame makes the soft money loan a better fit than a hard money loan for many borrower’s situations, particularly those interested in investing in a home or a more long-term property.

- Contributed Article

- April 2021 (Innovate)

- “I think a lot of our success is because we have a background in private lending and our clients can sense that we get ‘it’,” explained Lawrence Schwartz, who is one of the founders of Mortgage Automator. “We know what their needs are, we know what they struggle with, so we built a product that will make their lives easier. We take a lot of pride in that.”

- Contributed Article

- April 2021 (Innovate)

- "At any given time, I am working with numerous outside technical vendors including web developers, internal and external document coders, and workflow consultants to try to create a better loan document solution. We built a best in class nationwide online loan document solution that produces thousands of loan documents per month, and we’re not stopping anytime soon," says Nema Daghbandan, Esq. In this article, he discusses the importance of technology and how Lightning Docs was born.

- Contributed Article

- February 2021

- Kevin Kim, Esq. discusses the six incoming changes to federal securities exemptions that start March 15, 2021.

- Contributed Article

- February 2021

- "What every lender needs to ultimately decide is this what kind of capital partners they want to have for the long term and get a better understanding of how their respective capital partners will behave amid moments of crisis as it relates to the loans being originated. What our industry has seen repeatedly with each subsequent financial crisis is that traditional loan buyers in the secondary markets can change their risk profiles and as a result, their capital allocations, just as easily as an individual investor," says Tony Ingoglia, Chief Strategy Officer and Chief Investment Officer at Socotra Capital.

- Contributed Article

- February 2021

- "A well-balanced, thoughtful capital strategy ensures that the private lender has reliable, captive capital sources along with institutional capital markets plugged in as an added benefit or resource. This balanced approach not only provides liquidity and additional capital, but it grants the operator a significant level of control over their business’ direction," says Kevin Kim, Esq.

- Contributed Article

- February 2021

- Grayson Wester, VP of Marketing and Sales at Corridor Funding, discusses five key lessons for real estate investors who want to build long term wealth with a 30-year fixed rate loan.

- Contributed Article

- February 2021

- If 2020 taught us anything, it was not to make predictions with too much certainty. But both the residential and commercial real estate markets appear to be poised for a good – but not necessarily outstanding – year in 2021.

- Contributed Article

- November 2020

- "The takeaway here is that one needs to be extremely careful if one wants to invest in a fractionalized note – not only do you want to own more than 50% of the note, but make sure you know every other owner and have like minds, which, in today’s world, is more than a daunting task," says Edward Brown of Pacific Private Money.

- Contributed Article

- November 2020

- "At the American Association of Private Lenders, we get daily calls and emails asking if a lender’s terms sound fishy. What is out of the norm? Why should they believe you that these terms are normal for the variables involved? Being able to back up your terms with external data increases a borrower’s trust in you – and the industry," says Kat Hungerford, executive editor of Private Lender magazine and project development manager at the American Association of Private Lenders.

- Contributed Article

- October 2020

- Mark Hanf, president of Pacific Private Money, says that he likes to use a small amount of leverage, and on a very short term basis for his MDF for specific reasons; mostly, to help fund short term loans in his Fund when he is expecting payoffs on other loans or anticipated investor money flowing in. As soon as payoffs or investor money comes in, he immediately pays down line of credit [leverage]. This creates the benefit of having the ability to close deals that he might not otherwise have been able.

- Contributed Article

- October 2020

- "The Private Lending industry is a key part of our economic landscape. It allocates capital in a way that most large lending institutions don’t or can’t. The entrepreneurial spirit endemic to Private Lending professionals is similar to the mindset of self-directed IRA investors. Knowing the ability of IRAs to invest in private lending may provide a “win-win-win," says Clay Malcolm, Certified IRA Services Professional with Advanta IRA.

- Contributed Article

- September 2020

- "Relatively little attention has been geared toward reverse mortgages during the Covid virus. At first glance, the simple answer is that no monthly payments are required for reverse mortgages; thus, there is no risk for a foreclosure for non-payment of a mortgage. However, one needs to go deeper to understand that there could be a potential risk to the homeowner of losing their house in certain circumstances but for the foreclosure moratorium," says both Edward Brown of Pacific Private Money and Mary Jo LaFaye of Omaha Reverse Mortgage.

- Contributed Article

- September 2020

- "Acquiring new customers may form the business baseline for private lenders but customer retention is the key to excellence. It keeps the money flowing in the form of repeat . Focusing primarily on acquisition may bring new customers to your lending business, but without a focus on boosting customer loyalty and advocacy, you risk to disappoint your existing customer base which may prove counterproductive."

- Contributed Article

- September 2020

- "The coronavirus epidemic’s comprehensive economic toll on the approximately $16 trillion U.S. CRE market has started to become more apparent as facilities begin reopening in major metropolitan areas following an extended period of mass lockdown," says Darlene Hernandez, Esq., at Geraci LLP.

- Contributed Article

- August 2020

- According to Mark Hanf, president of Pacific Private Money, “Section 4021 of the CARES Act contained a regulation that loan servicers “shall report the credit obligation or account for those participating in forbearance as current.” In other words, those participating in a forbearance program should not see their credit scores drop. However, there is a loophole that allows lenders to discover whether or not a borrower is actually making payments. It is the “comments” section of a credit report.

- Contributed Article

- July 2020 (3rd Anniversary)

- "More and more, the fix-and-flip real estate investment approach is becoming the go-to method for turning a profit in the industry. While fix-and-flips are undoubtedly in-demand in today’s market, some investors are finding it challenging to offload their refurbished properties at a price point that will yield a favorable return on investment," says Lou Forino, co-founder of Gauntlet Funding.

- Contributed Article

- July 2020 (3rd Anniversary)

- For private lenders who typically rely on face-to-face networking, social media advertising can feel completely foreign. Ruby Keys, VP of Media at Geraci LLP, discusses how to advertise on five different social media platforms.

- Contributed Article

- July 2020 (3rd Anniversary)

- "As states begin to open, we are seeing demand return quickly. We anticipate this will grow as we reach a full easement of restrictions in all states over time. We feel the backlog from spring volume may just add to summer demand, so we are advising lenders to be aware of added turn times and potential fees as appraisers do charge more when demand is greatest," says John Tedesco, SVP of Business Development at Appraisal Nation.

- Contributed Article

- April 2020

- "For any business initiative to be successful, you have to continually evolve. If you don’t get the results you would expect, you should evaluate why then refine it and try again. Marketing moves quickly these days, and there are always new tools at your disposal," says Romney Navarro, partner at Noble Capital.

- Contributed Article

- April 2020

- "The proactive measures that the world is taking will, hopefully, curtail the coronavirus so that it is short-lived and we all can get back to a relatively normal life. However, the economic impact of this virus cannot be ignored," says Edward Brown of Pacific Private Money.

- Contributed Article

- April 2020

- "There’s a great deal of leads out there waiting to be tapped. All you need is a few robust strategies that will help you score these high-quality leads that are on the verge of getting converted to long-term clients," says Abhi Golhar of Summit & Crowne Partners.

- Contributed Article

- March 2020 (Women in Real Estate)

- At the end of the day, everyone struggles with staying focused and being productive all the time. Learning key techniques that work for you are essential to becoming a productivity master and to get the most out of every day.

- Contributed Article

- March 2020 (Women in Real Estate)

- Ruby Keys, Vice President of Geraci Media, shares a few tips she has learned to live a more intentional, focused, and fulfilled life both in and out of the workplace.

- Contributed Article

- March 2020 (Women in Real Estate)

- "Be mindful of the internal dialogue you tell yourself as you can change your story and your internal belief system. Feel the fear and do it anyways," says Kristina Sawyer, Vice President of Lending for Arixa Capital Advisors.

- Contributed Article

- March 2020 (Women in Real Estate)

- "It is important to remember that things don’t happen to you, they actually happen for you; preparing you for what is to come," says Elizabeth Morales, Chief Marketing Officer for Applied Business Software. She discusses what she wishes someone would have told her in her twenties and tips she has known all along.

- Contributed Article

- March 2020 (Women in Real Estate)

- "I don’t have a magic formula for success as I don’t feel I have “arrived”; however, the success I have gained to date I attribute to hard work and lots of sacrifices. Being prepared, having knowledge about my message and my product, remaining humble, and grinding every day," says Kendra Rommel, Sr. Account Executive at Civic Financial Services.

- Contributed Article

- March 2020 (Women in Real Estate)

- "Over the years, we’ve solidified our foundation so beyond being a well-run, well-organized association, we know who we are and what we want for the industry. Today, my vision is focused less internally and more on what we can do to grow the private lending industry’s prestige as the backbone of the real estate investment market," says Linda Hyde, managing director at the American Association of Private Lenders.

- Contributed Article

- February 2020

- "In order to stay ahead of the game in today’s competitive climate, private lenders must consider implementing digital solutions like custom software and artificial intelligence or chatbots. It’s super important that private lenders begin evaluating and incorporating innovative technology into their offerings," says Abhi Golhar of Summit & Crowne Partners.

- Contributed Article, Retired Columns

- February 2020

- "The oldest Millennials, who will turn 40 this year, came into prime homebuying age amid the nation’s financial crisis and the subsequent run-up of home prices during the economic recovery. With that experience as a sobering backdrop, this massive generation has forged its own path when it comes to renting versus homeownership," says Robert Greenberg, Chief Marketing Officer at Patch of Land.

- Contributed Article

- November 2019

- Although it can be difficult to ascertain the future state of non-bank lending, it is fairly easy to state the continued growth of the space. The aftermath of the last financial crisis in 2008 strengthened the presence of the non-bank lending sphere, and it seems as though the non-bank lending space is here to stay for quite some time," says Alta Capital Group President James Bowie.

- Contributed Article

- September 2018

- "Lending money from your IRA to the IRA of a real estate investor presents a unique possibility for mutual benefit. Your IRA can earn tax-advantaged income through the methods you’re already familiar with, while your borrower can acquire lucrative a property without having to come up with the full purchase price," says Clay Malcolm of New Direction IRA.

- Contributed Article

- September 2018

- We believe when the housing market begins to shows signs of a slowdown, the popularity of flipping among the “HGTV flippers” will quickly wane. As the amateur flippers exit in droves, competition for available inventory will decline, and many seasoned, experienced investors that have been sitting on the sidelines will re-emerge to take advantage of buying opportunities," says Robert Greenberg, Chief Marketing Officer at Patch of Land.

- Contributed Article

- September 2018

- "Although retrofit loans are substantially similar to other construction loans, their requirements will vary from state to state, county to county and city to city. Before making a retrofit loan it is essential to identify and understand all state and local laws regarding the financing and completion of these projects," says Dennis Baranowski, partner at Geraci LLP.

- Contributed Article

- September 2018

- JT Terrell of Music City Tents and Events LLC learned a lifetime of lessons during the trek he took with his son and his Boy Scouts group in 2016, including how to build a team and a business.

- Contributed Article

- August 2018

- As the central bank of the United States, the Federal Reserve monitors a series of factors throughout the year and generally boosts interest rates to offset inflation in a strong economy. Apart from that, the effect of higher interest rates on the American public can be two-fold: Mortgages from larger financial firms could become more expensive and stock prices can dip in unpredictable and undesirable ways," says Clay Malcolm of New Direction IRA.

- Contributed Article

- August 2018

- "There aren’t easy answers to the many questions that arise when the conversation turns to technology in origination, and specifically to automation and AI. These aren’t questions that can be answered overnight, but they are certainly questions that originators need to be talking about and acting upon with a level of urgency," Robert Greenberg of Patch of Land.

- Contributed Article

- July 2018

- "What are your torches of freedom? What perception do you want to create that makes you appear better, faster, and stronger? Create the perception. Own the reality," says Anthony Geraci, partner and CEO at Geraci LLP.

- Contributed Article

- July 2018

- "When it comes to the people or businesses who provide your income, making their priorities your priorities can pay dividends. As internet consumers take a closer look at how their information is shared, you can set yourself apart by laying your cards on the table and proving that you’re a responsible lender with nothing to hide," says Clay Malcolm of New Direction IRA.

- Contributed Article

- July 2018

- "You need to be honest with yourself and the people in your life about how you are feeling, right now. Learn from the mistakes made by so many who have come before you and drill down on the stuff that keeps you awake at night," says JT Terrell of Music City Tents and Events LLC.

- Contributed Article

- March 2018

- "What goals can you set SMARTly? What will you accomplish? 2018 is a brand new year. If you’re searching for that one person that will change your life, take a look in the mirror," says Anthony Geraci, partner, and CEO at Geraci LLP.

- Contributed Article

- November 2017

- If the referral source — say, a commercial real estate broker — starts to negotiate terms, then he is working as a commercial mortgage broker. In those states requiring a license to broker commercial loans, the referral source is now breaking the law. Therefore, don’t let your referral sources gather documents for you or issue loan quotes," says George Blackburne, Blackburne & Sons Realty Capital Corporation.

- Contributed Article

- November 2017

- "Yes, time is money for loan originators. You may be hesitant to spend too much of your helping someone you hardly know. But mentoring does not have to take a lot of time. It can be as simple as letting a young investor take you out to lunch and answering his or her questions," says Gene Clark of 5 Arch Funding.

- Contributed Article

- November 2017

- "If you want more control, more money, and more deals, you should look into forming a mortgage fund. You’ll wonder why you went so long without one," says Kevin Kim of Geraci LLP.

- Contributed Article

- September 2017

- "Do you really want to grow, improve, and expand? Then strive to rid your organization of internal and external selfishness. Don’t merely look out for your own interests, but find partners in which you and your team can invest and trust," says Linda Hyde of American Association of Private Lenders.

- Contributed Article

- September 2017

- "When someone passes away during the loan process, real property with a clear title may pass to an heir if the previous owner has gone through the probate process in the county in which the property is located. The title must be examined by a title agent, who searches for any defects in the title (judgments, liens, mortgages, unpaid tax bills, etc.) within the last 60-plus years," says Kasey RJ Stevens of Top Division Escrow.

ABOUT ORIGINATE REPORT

Our story at Originate Report began in 2017 with a singular idea: providing value to our readership. Through many iterations since its inception, Originate Report has risen to the challenge. We’ve grown our readership while honing in on what industry leaders need to know.

Today, our quarterly publication is found both in print at industry conferences and via digital distribution channels that provide thousands of loan originators, lenders, investors, and service providers in the non-conventional lending industry with the insight they require to weather industry trends and grow their businesses.

Everyone has a story to tell and we, at Originate Report, strive to ensure yours gets heard.